New vs. Old Tax Regime: Finding Your Break-Even Point in India

In simpler terms, the break-even point refers to the specific amount of deductions you need to claim under the old tax system. By claiming this amount, you end up paying the same amount of tax as you would in the new tax system.

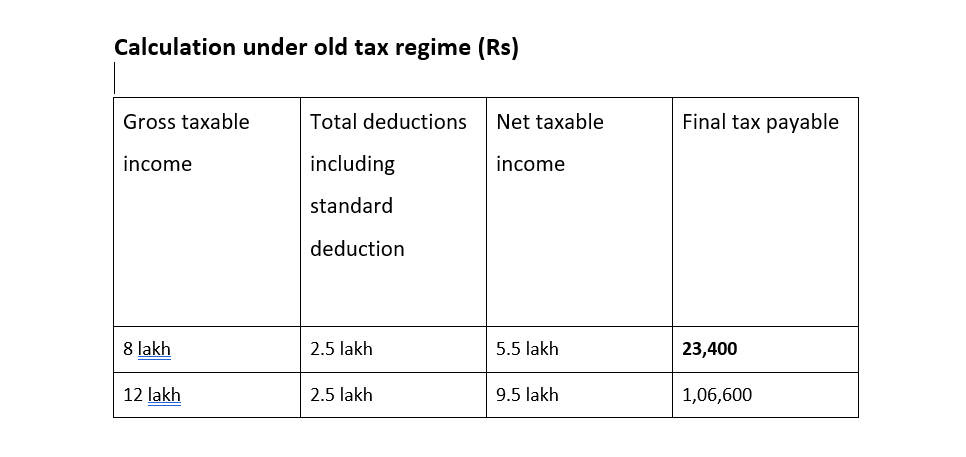

The table breaks down the minimum deduction requirement for different income levels under the old tax regime. This deduction amount is the break-even point where your tax bill will be the same in both the old and new tax regimes.

New vs. Old Tax Regime: the table shows the minimum amount of deductions you need to claim in the old system to pay the same tax as you would in the new system. If your deductions are higher than this amount, sticking with the old system might be beneficial.

The passage explains that after a certain income threshold (Rs. 15.5 lakh), the minimum deduction amount remains constant under the old tax regime. This is because the income tax rate applicable in the new tax regime also stabilizes at that point. However, it’s important to remember that surcharges apply to taxable income exceeding Rs. 50 lakh, so the minimum deduction amount required to achieve the break-even point will change for such high incomes.

The table you’re referring to applies specifically to salaried individuals who benefit from a standard deduction of Rs. 50,000 on their salary income under both the old and new tax regimes. It’s important to note that this table doesn’t take into account the deduction available for an employer’s contribution to the National Pension System (NPS). If a salaried person claims this deduction under both regimes, the break-even point (minimum deduction amount needed for the same tax liability in both regimes) will actually be lower. In other words, the table shows slightly higher break-even amounts because it excludes this additional deduction.

The table is specifically applicable to salaried individuals who benefit from a standard deduction of Rs. 50,000 under both tax regimes. This standard deduction is not available to non-salaried individuals, such as self-employed individuals.

As a result, the minimum amount of deductions required to achieve the break-even point (where tax liability is the same under both regimes) will differ for non-salaried individuals. They will need to claim a higher total deduction amount compared to salaried individuals to reach the same tax benefit under the old tax regime.

The table showcases this difference by illustrating the higher minimum deductions required for non-salaried individuals at various income levels.

New vs. Old Tax Regime : The old tax regime offers a number of ways for individuals to reduce their taxable income through deductions and exemptions:

-

Deductions under Section 80C: This is a popular section that allows both salaried and non-salaried individuals to claim deductions up to a maximum of Rs 1.5 lakh per year. To qualify for this deduction, you need to invest in or spend money on specific things, such as:

- Contributions to Employee Provident Fund (EPF)

- Public Provident Fund (PPF)

- Equity Linked Savings Scheme (ELSS) Mutual Funds

- Repayment of principal amount on a home loan

- Tuition fees for your children’s education

-

Other Deductions and Exemptions: Besides Section 80C, the old tax regime offers various other deductions and exemptions that can further reduce your taxable income. These can get quite complex, so it’s always best to consult with a tax advisor to see what applies to your specific situation.

Beyond Section 80C: The old regime offers further deductions to help you save on taxes:

-

National Pension System (NPS): You can claim an additional deduction of up to Rs. 50,000 for investments made in NPS according to specific rules. This, combined with the Rs. 1.5 lakh limit under Section 80C, allows for a total deduction of Rs. 2 lakh.

-

Health Insurance Premiums: Deductions are available for health insurance premiums paid, with the maximum amount depending on your age and who you’re covering:

- Up to Rs. 25,000 or Rs. 50,000 for your own health insurance.

- An additional Rs. 25,000 or Rs. 50,000 for your parents’ health insurance, depending on their age.

-

Medical Expenses for Senior Citizens’ Parents: If your senior citizen parents aren’t covered by health insurance, you can claim a deduction of up to Rs. 50,000 for their medical expenses.

By taking advantage of these deductions, you can significantly reduce your taxable income under the old tax regime.

Deductions for home loans, education loans, and interest income:

Owning a Home and Education Expenses:

-

Home Loan Interest: If you’ve taken out a home loan, you can deduct up to Rs. 2 lakh for the interest paid during the financial year. This helps reduce your taxable income.

-

Education Loan Interest: The old tax regime offers a welcome benefit for those pursuing education through loans. You can claim a deduction for the interest paid on an education loan, with no limit on the amount. This can significantly reduce your tax burden.

Earning Interest:

-

Savings Account Interest: Under Section 80TTA, some of the interest you earn from your savings account can be deducted from your taxable income.

-

Senior Citizen Interest Income: Senior citizens get an even better deal! Section 80TTB allows them to deduct up to Rs. 50,000 of interest income earned from various deposits, including savings accounts and fixed deposits.

See Also:

Old Regime vs New Regime – Choosing the Right Tax Regime: Deductions Make the Difference