Old Regime vs New Regime – Choosing the Right Tax Regime: Deductions Make the Difference

Choosing the Right Tax Regime (Old Regime vs New Regime)

- Deciding between the old and new tax regimes can be tricky. It depends on how much you can reduce your taxable income with deductions from your gross income.

- Knowing the breakeven point is key. This is the minimum deduction amount where you pay the same tax under both regimes.

- Claim more deductions than the breakeven point? Choose the old regime. You’ll likely pay less tax.

- Claim less deductions than the breakeven point? The new regime might be better. It offers lower tax rates.

Choosing Your Tax Regime for TDS: Estimates Now, Final Calculations Later

- Understanding minimum deductions helps you pick a tax regime that minimizes your tax burden.

- For TDS on salary, you’ll estimate your income and deductions for the year.

- Final tax calculations happen when you file your return using actual income and deduction figures.

- You can even switch between regimes at tax filing time if needed.

No Changes to New Tax Regime for FY 2024-25 (Old Regime vs New Regime)

- The income tax rules for the new regime remain the same as those introduced in April 2023 and apply to the current financial year (FY) 2024-25.

- This means all taxpayers continue to benefit from a basic exemption of Rs 3 lakh.

- The new regime also continues to offer multiple tax slabs with lower tax rates compared to the old regime.

New Tax Regime Deductions for Salaried Individuals:

- You get a standard deduction of Rs 50,000 to reduce your taxable income.

- You can also claim your employer’s contribution to your National Pension System (NPS) account, with a limit:

- Up to 10% of your salary for private sector employees.

- Up to 14% of your basic salary for government employees.

Old Regime Deductions Depend on Your Income

While we discussed the new regime’s deductions, remember:

- The minimum deductions needed in the old regime to pay the same tax as the new regime will vary based on your income level.

In simpler terms, the amount of tax deductions you need to claim under the old regime to benefit from it depends on how much you earn.

Break-Even Level: Choosing the Right Regime

Let’s take income level into account:

- Imagine A and B with different incomes: Rs 8 lakh and Rs 12 lakh respectively.

- To pay the same tax under both regimes, A and B would need different minimum deduction amounts in the old regime. We call this their break-even level.

- Here’s the key takeaway: If your actual deductions in the old regime fall below your break-even level, the new tax regime might be better because it offers lower tax rates.

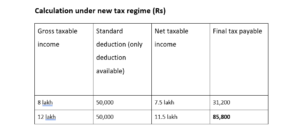

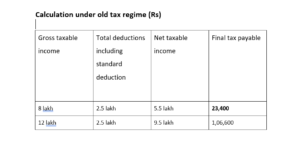

Let’s break down the concept of break-even level with an example:

- Consider A and B, earning Rs 8 lakh and Rs 12 lakh respectively in a year.

- Both claim deductions of Rs 2.5 lakh, which includes the standard Rs 50,000 deduction.

Here’s the key point:

We don’t know yet if the Rs 2.5 lakh deduction is enough for them to benefit from the old tax regime. Each will have a different break-even point (minimum deduction required in the old regime to pay the same tax as the new regime).

- If their actual deduction is higher than their break-even level (e.g., Rs 3 lakh for A and Rs 4 lakh for B), the old regime might be better.

- However, if their deduction is lower than their break-even level, the new regime’s lower tax rates might be more beneficial.

Old Regime vs New Regime – The Example Explained: Choosing the Right Regime Matters

- In this example, with a Rs 8 lakh income and Rs 2.5 lakh deductions (including standard deduction), the old tax regime saves Mr. A money compared to the new regime.

- However, for Mr. B with a Rs 12 lakh income and the same Rs 2.5 lakh deductions, the new regime offers a lower tax bill.

- This highlights the point: The benefit you get from deductions in the old regime depends on your income level. With a higher income (like Mr. B), you’ll need more deductions than Rs 2.5 lakh to make the old regime worthwhile.

You must be logged in to post a comment.