Market Update: Oil Prices Dip, Tech Stocks Mixed, Markets Cautious

Global oil prices are projected to decline due to weak demand and potential easing of geopolitical tensions. In domestic markets, Paytm reported a Q2 profit, driven by the sale of its ticketing business. However, UltraTech Cement’s Q2 results were weaker than expected, despite growth plans. Domestic indices, the Sensex and Nifty, are currently trading in the negative territory. Authum Investment & Infrastructure’s stock fell 11% due to weak Q2 performance. Brokerages have mixed opinions on UltraTech’s future performance.

CONTENTS:

- Oil may drop, Authum weak, UltraTech up, Paytm profit, markets down

- Oil prices may fall due to weak demand and potential conflict resolution.

- Authum stock falls 11% due to weak Q2 results.

- UltraTech shares up on growth plans, Q2 weak, brokerages mixed.

- Paytm Q2 profit Rs 930 crore, revenue down 34%, loss before tax up 49%.

- Sensex and Nifty trade in the negative zone.

Market Update: Oil Prices Dip, Tech Stocks Mixed, Markets Cautious

Oil may drop, Authum weak, UltraTech up, Paytm profit, markets down

– Crude oil prices may drop to the low $60s by the end of 2025 despite ongoing geopolitical tensions.

– Authum Investment & Infrastructure has seen a 12% decline in its stock due to a weak Q2 performance, with profits down by 56%.

– UltraTech Cement’s stock has risen by 2% as the company aims for 7-8% growth, though brokerages have varying opinions.

– Paytm reported a Rs 930 crore profit in Q2 after selling its ticketing business, but its shares slipped by 5%.

– Sensex and Nifty are currently trading in the negative zone as of the latest updates.

Oil prices may fall due to weak demand and potential conflict resolution

Market Update: Oil Prices Dip, Tech Stocks Mixed, Markets Cautious Crude oil prices could fall to the low $60s by the end of 2025, after rising to $80 per barrel in the last quarter of 2024, a nearly 10% increase from current levels, according to JP Morgan analysts. They note that key West Asian countries like Saudi Arabia and the UAE are incentivized to contain the ongoing conflict due to economic transformations in the Gulf region. Natasha Kaneva, head of Global Commodities Strategy at JP Morgan, highlighted that low oil inventories could maintain a geopolitical premium on crude prices until the conflict is resolved.

Brent crude prices saw steady growth in the past month, climbing from $71 per barrel in late September to about $81 in early October, driven by West Asian tensions. However, prices have since fallen back to around $73 amid demand concerns and hopes that the conflict may remain contained.

A weak demand outlook, particularly due to concerns about economic slowdowns in China and the US, is also impacting prices. Rabobank International analysts expect an oversupply of around 700,000 barrels per day in 2025, adjusting their forecasts accordingly. They now predict Brent will average $71 in Q4 2024, with prices stabilizing around $70 in 2025 and rising to $72 and $75 in 2026 and 2027, respectively. Poor demand from China and the US, along with a looming supply glut, has led Rabobank to revise its models.

The EIA has also lowered its 2025 oil demand growth forecast by 300,000 barrels per day, now projecting a 1.2 million bpd increase to 104.3 million bpd due to weaker economic activity in China and North America. Meanwhile, OPEC has similarly reduced its demand growth forecasts for 2024 and 2025.

JP Morgan reports that global crude inventories are at their lowest since January 2017, with current stocks at 4.4 billion barrels, significantly below last year’s levels when Brent traded at $92 per barrel. Both OECD crude and liquid inventories are below their five-year range, and stocks at Cushing are at a 15-year low.

Rabobank’s analysis also notes a sharp sell-off in oil prices over the past few weeks, with Brent closing at $78.80 at the end of August before dropping to $68.68 in early September. Prices have since rebounded to about $74 per barrel, but analysts expect further declines, predicting that crude could test a low of $66.10 later this year.

Authum stock falls 11% due to weak Q2 results

Market Update: Oil Prices Dip, Tech Stocks Mixed, Markets Cautious Shares of Authum Investment & Infrastructure fell by 11.7% to Rs 1,647.30 on the BSE during Monday’s intraday trading, following a weak financial performance in the second quarter of FY 2024-25 (Q2FY25). The company, a non-banking financial institution (NBFC), reported consolidated revenue of Rs 1,092.62 crore for Q2FY25, a 49.2% year-on-year (YoY) decline from Rs 2,151.75 crore in the same quarter last year. Sequentially, revenue also dropped by 22.3% compared to Rs 1,416 crore in Q1FY25.

Profit after tax stood at Rs 842.77 crore for Q2FY25, down 56.5% YoY from Rs 1,939.81 crore, and 23.1% lower than the Rs 1,096.64 crore recorded in Q1FY25. The company’s total expenses rose by 45% to Rs 157.24 crore, compared to Rs 107.79 crore in the same quarter last year.

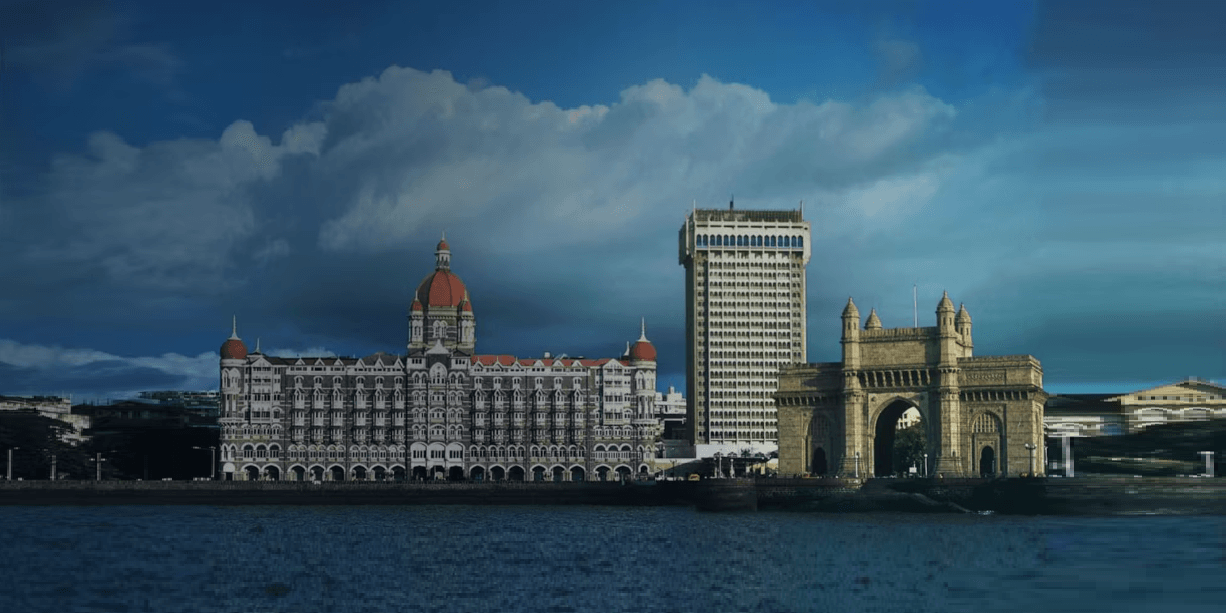

Authum Investment & Infrastructure, based in Mumbai, specializes in investing in financial instruments, including shares, securities, real estate, and loans. The firm invests in both listed and unlisted companies, offering growth capital, private equity, real estate investments, and debt instruments. It also provides structured financing, secured lending, and equity investments in emerging companies.

Despite the recent decline, the company’s stock has performed well over the year, increasing by 65.9% year to date and 107.4% over the past year. In comparison, the BSE Sensex has risen by 12.2% year to date and 24% in one year. Authum’s market capitalization stands at Rs 27,989 crore, with a price-to-earnings ratio of 8.63 and earnings per share of Rs 216.30. As of 10:18 AM, the stock was down 10.2% at Rs 1,676.20, while the BSE Sensex had declined by 0.14% to 81,037.

UltraTech shares up on growth plans, Q2 weak, brokerages mixed

Market Update: Oil Prices Dip, Tech Stocks Mixed, Markets Cautious Shares of UltraTech Cement rose by up to 1.88%, reaching an intraday high of Rs 11,074.60, a 2.96% gain from the day’s low of Rs 10,755.30. This increase followed the company’s announcement of its plans for 7-8% growth in the coming years, driven by the expanding demand in India’s cement sector, supported by government infrastructure spending and urban housing demand.

However, UltraTech’s Q2 FY25 financial results fell short of expectations. The company’s consolidated profit dropped 36% year-on-year (YoY) to Rs 825 crore, down from Rs 1,280 crore in Q2 FY24, while revenue declined 2% to Rs 15,635 crore. Operating performance was also impacted, with earnings before interest, tax, depreciation, and amortization (EBITDA) down 21% YoY to Rs 2,019 crore, and EBITDA margins shrinking by 300 basis points to 12.9%. Capacity utilization stood at 68% for the quarter, with domestic sales volume growing 3% despite weather disruptions.

On the cost front, energy expenses fell by 14%, but raw material costs rose by 1%, attributed to increased prices for fly ash and slag. UltraTech also secured $500 million through a sustainability-linked loan, marking its second such financing effort.

Brokerages had mixed responses. InCred Equities maintained an ‘Add’ rating but reduced their EBITDA estimates by 7-12% for FY25-27, setting a target price of Rs 12,190. Motilal Oswal acknowledged margin pressures but highlighted UltraTech’s cost-saving measures and capacity expansion plans, projecting a compound annual growth rate (CAGR) of 16% for EBITDA and 18% for profit. Their target price is now Rs 13,000. Nuvama analysts revised their EBITDA estimates down by 9% for FY25 and adjusted their target price to Rs 11,238, reflecting weak demand and pricing.

International brokers were also divided. Morgan Stanley maintained an ‘Overweight’ rating with a target price of Rs 13,620, while Macquarie and CLSA held ‘Neutral’ ratings with targets of Rs 11,106 and Rs 11,500, respectively. Nomura continued to recommend ‘Buy’ with a target of Rs 12,350. Bank of America also retained its ‘Buy’ rating but lowered its target to Rs 12,300, and Goldman Sachs adjusted its target to Rs 11,720.

Paytm Q2 profit Rs 930 crore, revenue down 34%, loss before tax up 49%

Market Update: Oil Prices Dip, Tech Stocks Mixed, Markets Cautious Paytm reported Q2 FY25 revenue from operations of Rs 1,659.5 crore, marking a 34% decline year-on-year from Rs 2,518.6 crore. The company’s loss before exceptional items and tax increased to Rs 406.5 crore, compared to Rs 273.3 crore in the same period last year.

However, Paytm recorded an exceptional gain of Rs 1,345.4 crore from selling its ticketing business to Zomato during the quarter. As a result, the company posted a profit before tax of Rs 938.9 crore, compared to a loss of Rs 279 crore a year ago. Paytm also reported a net profit of Rs 930 crore for the quarter, reversing the Rs 291.7 crore loss from the same period last year.

Sensex and Nifty trade in the negative zone

Market Update: Oil Prices Dip, Tech Stocks Mixed, Markets Cautious India’s benchmark indices, BSE Sensex and Nifty 50, were trading in negative territory on Tuesday after a mixed start to the trading session.

As of 11 AM, the BSE Sensex had risen by 128.56 points (0.16%) to 81,022, while the Nifty 50 was up 60.65 points (0.24%) at 24,720.

Check out TimesWordle.com for all the latest news