IBM HashiCorp Acquisition: Big Blue Expands Cloud Portfolio for $6.4 Billion

IBM is acquiring HashiCorp, a company that specializes in cloud infrastructure automation, for $6.4 billion. This deal will allow IBM to expand its cloud-based software offerings and cater to the increasing demand for AI-powered solutions. The acquisition comes at a time when IBM’s consulting business is facing challenges due to cautious spending by enterprises. However, software sales have been a bright spot for IBM.

IBM is paying a premium of 42.6% over HashiCorp’s closing price on Monday, reflecting the high value it places on the company’s technology.

Investors reacted differently to the news of IBM acquiring HashiCorp and stock price jumped over 4% in after-hours trading, likely due to the acquisition news.

Conversely, IBM’s stock price dropped 7% after the company reported lower-than-expected revenue for the first quarter.

IBM’s total revenue of $14.46 billion fell slightly short of analyst estimates of $14.55 billion.

The company’s consulting business also showed flat growth during the quarter.

There’s a contrasting trend between IBM and its competitor, Accenture.

Accenture reduced its revenue forecast for 2024 due to decreased client spending on consulting services.

On the other hand, IBM’s software sector showed positive growth of 5.5% in the first quarter.

This growth reflects IBM’s focus on cloud-based solutions, crucial for storing and processing data used in AI programs.

Their “AI book of business” surpassed $1 billion in the first quarter, demonstrating continued growth in AI-related sales and bookings.

Impact of the IBM HashiCorp Acquisition:

IBM plans to use its existing cash reserves to fund the purchase of HashiCorp.

The acquisition is expected to be finalized by the end of 2024 and contribute positively to IBM’s core profits within the first year after closing.

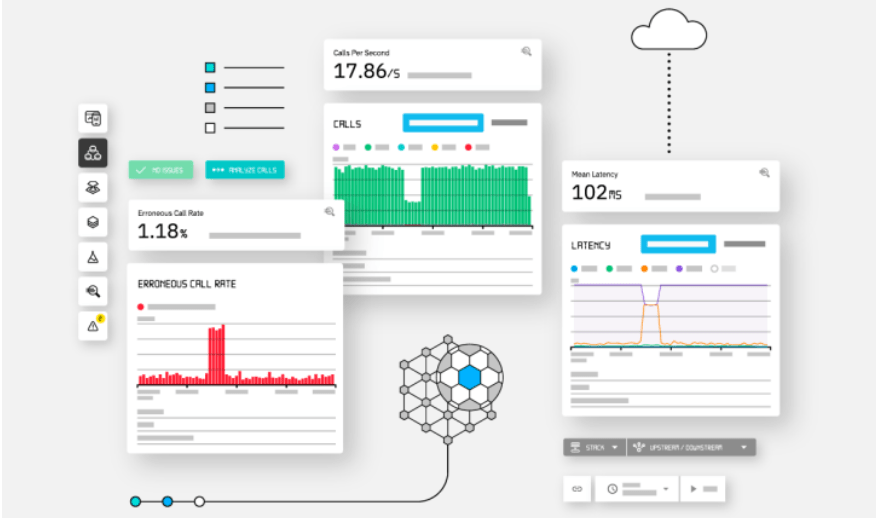

HashiCorp, based in California, helps businesses set up and manage their cloud infrastructure.

Industry experts see this deal as a strategic move for IBM. They believe HashiCorp’s leadership in the field and its compatibility with IBM’s existing offerings make it a wise acquisition.

IBM’s earnings:

IBM’s adjusted earnings per share for the first quarter (ending March) exceeded expectations. They reported $1.68 per share, which is higher than the average analyst estimate of $1.60.

One thought on “IBM HashiCorp Acquisition: Big Blue Expands Cloud Portfolio for $6.4 Billion”