HEG Stock Price Soars 60% Then Plunges 7% in One Day – Here’s Why!

HEG Ltd. is undergoing a major restructuring. The company will demerge its graphite business, which makes up most of its revenue, into a separate entity. HEG will then merge with Bhilwara Energy and focus on green energy ventures. The stock price initially surged but fell after the announcement due to concerns about margins in the remaining business.

CONTENTS: HEG Stock Price Soars 60% Then Plunges 7%

HEG Restructuring

– HEG Stock Price Soars 60% Then Plunges 7%

HEG has approved the demerger of its graphite business, which accounted for 94% of its FY24 revenue, into a new company. Additionally, HEG will merge with Bhilwara Energy. This strategy aims to unlock shareholder value. Following the announcement, HEG’s stock dropped by 7% due to three-year low margins.

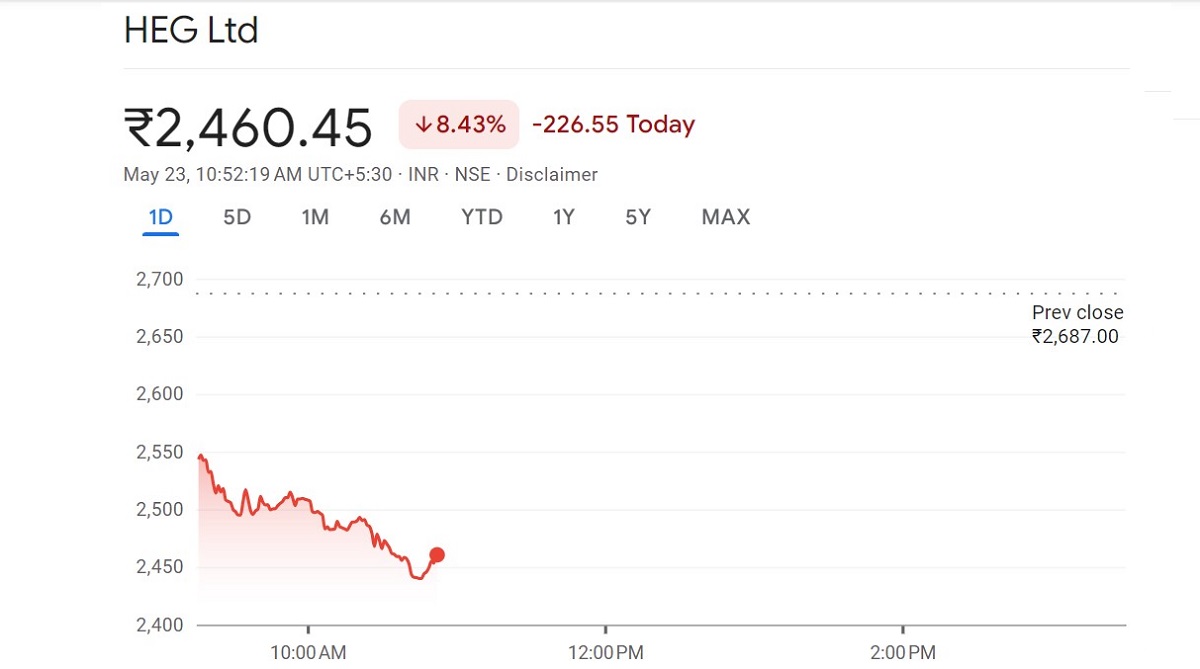

HEG Stock Plunges

Shares of HEG Ltd. have surged 60% over the past six months. However, following the announcement of the spin-off of its graphite business, traders began selling off the stock. On Thursday, it dropped by 7%, reaching a day’s low of ₹2,509.20.

HEG Restructures for Value

Graphite electrode manufacturer HEG has approved the demerger of its graphite business into a separate company and the merger of Bhilwara Energy with itself. This strategy aims to unlock shareholder value.

In FY24, the graphite business accounted for 94.41% of the company’s total turnover.

HEG stated that the graphite business is expected to be listed by 2025.

HEG Pivots to Green Energy

According to a company notification on May 22, the existing company will transform into a platform for green energy ventures, including hydro and wind energy, advanced carbon businesses, and other emerging opportunities.

The demerger will involve a share swap ratio of 1:1, while for the merger, HEG specified that shareholders will receive “8 fully paid-up equity shares of ₹10 each of the transferee company for every 35 equity shares of ₹10 each of the transferor company.”

The resulting company’s equity shares issued will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

HEG Demerger Boosts Flexibility

In an update, HEG stated that segregating businesses with differing risk and return profiles provides shareholders with increased flexibility to align their investments with their strategies and risk preferences, effectively reducing the risk associated with the graphite business.

Ravi Jhunjhunwala, Chairman and Managing Director, CEO of HEG Ltd., mentioned that the existing company and the new company will embark on separate paths as independent, publicly listed entities. He highlighted that the growth drivers, risk profiles, and capital allocation requirements significantly vary between the graphite business and the green energy business.

HEG Demerger Unlocks Value

Jhunjhunwala expressed that the Scheme would allow both companies to pursue their respective strategies with focused management. He emphasized that this approach would unlock the full value of each business for the benefit of the shareholders.

Check out TimesWordle.com for all the latest news