U.S. and India Near Tariff Truce: A Strategic De-escalation with Global Implications

Based on a positive diplomatic thaw following a call between former President Trump and Prime Minister Modi, India’s Chief Economic Adviser has expressed strong confidence that the U.S. will soon scrap the recent punitive 25% tariff on Indian goods—imposed as retaliation for India’s purchase of Russian oil—and may also reduce the longstanding reciprocal tariff from 25% down to 10-15%. This anticipated resolution, which sparked a rally in Indian markets, signals a crucial de-escalation that prioritizes the broader U.S.-India strategic partnership aimed at countering China over a singular point of contention, marking a significant step towards stabilizing a critical economic and geopolitical relationship.

U.S. and India Near Tariff Truce: A Strategic De-escalation with Global Implications

In a significant development that could reshape the economic and strategic landscape of the Indo-Pacific, India’s Chief Economic Adviser, V. Anantha Nageswaran, has expressed strong confidence that the United States is poised to remove punitive tariffs on Indian goods. This move, potentially arriving within months, signals a crucial de-escalation of a trade dispute that had cast a shadow over one of the world’s most critical partnerships. The anticipated resolution goes beyond mere economics; it is a testament to the complex diplomatic dance between democracies navigating a fractured global order.

The Heart of the Dispute: From Trade to Geopolitics

The friction began not over traditional trade imbalances, but as a direct consequence of the war in Ukraine. In August, former President Donald Trump, in a decisive move to intensify pressure on Moscow, imposed a punitive 25% levy on India, effectively doubling the overall tariffs on certain key Indian exports to a staggering 50%. This was a direct response to India’s continued purchase of Russian oil—a pragmatic energy security decision by New Delhi that clashed with Washington’s foreign policy objectives.

This action transcended a simple tariff war. It struck at the core of the U.S.-India strategic partnership, a relationship painstakingly built over two decades to serve as a counterbalance to an increasingly assertive China. The tariffs introduced an unexpected point of tension, raising uncomfortable questions about the partnership’s resilience and whether shared democratic values could withstand divergent national interests.

The Thaw: Behind the Scenes of a “Positive and Forward-Looking” Dialogue

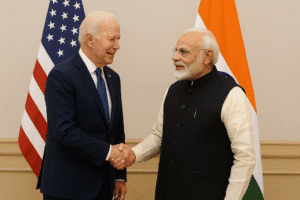

The path to reconciliation appears to have been paved by a combination of diplomatic outreach and shifting strategic realities. The recent “positive and forward-looking” trade discussions mentioned by New Delhi were undoubtedly crucial. However, the catalyst seems to have been a high-stakes phone call between former President Trump and Indian Prime Minister Narendra Modi.

While details were scarce, Trump’s statement thanking Modi for his “help in ending the war” is highly revealing. It suggests that Indian diplomacy, which has maintained channels with both Moscow and Kyiv, is being recognized in Washington as a valuable, neutral asset rather than a recalcitrant ally. This acknowledgment of India’s unique geopolitical position has likely softened the U.S. stance, allowing trade officials to negotiate from a place of mutual interest rather than punitive measures.

What a Resolution Actually Means: Beyond the Headlines

According to CEA Nageswaran, the resolution could be two-fold:

- Scrapping the “Extra Penal Tariff”: The immediate removal of the additional 25% tariff imposed in August. This would bring duties back to their pre-August levels, providing immediate relief to affected Indian exporters.

- Reducing the “Reciprocal Tariff”: A more substantial, long-term reduction of the base 25% tariff—often applied by the U.S. on steel, aluminum, and other goods—down to a more manageable 10-15%.

This second point is the real prize for India. A reduction to this level would not only ease the cost of exporting to the massive U.S. market but would also represent the most tangible progress in years on the broader, often stalled, U.S.-India trade dialogue. It would restore a sense of predictability and fairness that is essential for long-term business investment and supply chain integration.

Market Euphoria and Economic Realities

The markets reacted with unbridled optimism. Indian equity benchmarks, notably the Nifty 50, surged to one-week highs, reflecting investor relief. Sectors directly in the line of fire—metals, engineering goods, and certain textile exporters—saw particularly strong gains. This market response underscores a critical point: the U.S.-India trade relationship, while sometimes fraught, is deeply integrated. Stability and open channels are worth billions in market capitalization.

For American businesses and consumers, a resolution means more stable pricing and supply chains for goods imported from India. For Indian exporters, it means regained competitiveness and the ability to plan for growth without the sword of Damocles hanging over them.

The China Factor: The Unspoken Driver of Reconciliation

While the Ukraine war was the trigger for the dispute, the unspoken backdrop to the reconciliation is undoubtedly China. Both Washington and New Delhi view Beijing’s ambitions with deep strategic concern. A prolonged and public trade war between the U.S. and India would only serve China’s interests, potentially driving a wedge between the two nations and weakening the strategic Quad alliance (with Japan and Australia).

Mending this rift is a strategic imperative for both capitals. It allows them to refocus their collective diplomatic, military, and economic attention on the Indo-Pacific, reinforcing supply chains away from Chinese dominance and presenting a united front. The tariff de-escalation is, therefore, less about conceding a point and more about prioritizing a hundred-year strategic objective over a short-term tactical disagreement.

Expert Insight: Why This Matters in the Long Run

Dr. Sameer Patil, Senior Fellow at the Observer Research Foundation in Mumbai, notes, “This potential resolution is a masterclass in mature diplomacy. It demonstrates that both the U.S. and India have learned to compartmentalize their disagreements. They can have a sharp difference on one issue, like Russia, while aggressively collaborating on others, like technology sharing, naval exercises, and countering China. This agility is the mark of a truly resilient partnership.”

He adds, “The key takeaway for global observers is that the U.S.-India relationship is simply too big to fail. The economic and strategic costs of letting it deteriorate are astronomically high for both sides.”

Looking Ahead: A Cautious Optimism

While CEA Nageswaran’s “personal confidence” is a powerful signal, it is not a done deal. The final details will need to be negotiated by trade officials, and any agreement will need to withstand political scrutiny in both countries. However, the high-level political blessing from both Trump and Modi makes a positive outcome highly probable.

The coming months will be critical. The world will be watching not just for the official announcement of the tariff rollback, but for what it enables next: a potential resurgence in negotiations for a broader limited trade agreement, deeper collaboration in critical technologies, and a reinforced strategic alignment that will define the geopolitics of the Asian century.

This isn’t just a story about tariffs coming down; it’s a story about a strategic partnership weathering a storm and emerging stronger, with profound implications for global trade and security.

You must be logged in to post a comment.