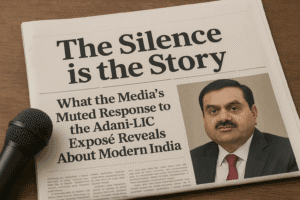

The Silence is the Story: What the Media’s Muted Response to the Adani-LIC Exposé Reveals About Modern India

The Washington Post’s investigation alleging the Modi government directed LIC’s massive $3.9 billion investment into the Adani Group was met in India not with vigorous journalistic inquiry but with a telling silence, as the mainstream media largely bypassed the substance of the allegations to headline the official denials from LIC and quotes from unnamed officials dismissing the report.

This muted response stands in stark contrast to the media’s aggressive pursuit of scandals in previous administrations and reveals a transformed media landscape where concentrated corporate-political power, legal intimidation, and a re-framing of critical reporting as anti-national have created a chilling effect, shifting the crucial role of holding power accountable to under-resourced independent platforms while the traditional fourth pillar of democracy retreats.

The Silence is the Story: What the Media’s Muted Response to the Adani-LIC Exposé Reveals About Modern India

In a healthy democracy, a major international investigation alleging that a government secretly directed billions of public dollars to a favoured billionaire would be political dynamite. It would dominate headlines, fuel prime-time debates, and force officials into frantic, public rebuttals. The story itself would become a story, its every facet examined and re-examined.

But in India today, the loudest sound following the Washington Post’s investigation into the Life Insurance Corporation’s (LIC) massive investments in the Adani Group was not an outcry, but a resounding, telling silence.

The Post’s report, published on October 25, 2025, alleged that a plan for LIC to invest $3.9 billion in Gautam Adani’s companies was “crafted by officials at the Department of Financial Services (DFS) in coordination with LIC and Niti Aayog,” and “approved by the Finance Ministry.” It painted a picture of a systemic effort to funnel taxpayer-backed capital to a specific, politically connected conglomerate, framing it as a vivid illustration of Adani’s clout within the Modi government.

Yet, when this story landed in the Indian media ecosystem, it didn’t explode; it fizzled. The headlines that followed were a study in uniformity and deflection: “LIC refutes Washington Post report,” “Made investments independently,” “‘False and baseless’: LIC denies.” The substance of the allegations—the documents, the coordination, the alleged circumvention of due process—was buried beneath the weight of the denial. For the average reader, the takeaway was simple: a foreign newspaper got it wrong, and our trusted institutions have clarified the matter.

But this tepid response is not a mere footnote. It is, in fact, the central plot. The media’s muted reaction to the Adani-LIC story speaks volumes about the state of Indian democracy, the transformation of its press, and the chilling effect of concentrated power. It’s a story not just about money and influence, but about the questions that go unasked and the stories that die before they are ever truly born.

The Anatomy of a Non-Scandal: Denials and Unnamed Sources

The Indian media’s playbook for handling the story was remarkably consistent. Most outlets led with LIC’s official, unsigned statement on X (formerly Twitter), declaring the report “false, baseless, and far from the truth.” This was presented as a conclusive refutation. The Economic Times, Mint, and The Hindu all led with this angle, framing the narrative around the denial rather than the allegation.

A more nuanced, yet equally problematic, approach was seen in The Indian Express. It provided more detail on the Post’s claims but balanced them with quotes from unnamed government officials who dismissed the documents cited by the Post. “DFS has not written any letter to LIC asking it to invest in the Adani Group… The documents being mentioned in the media are not from DFS,” an anonymous official stated.

This creates a critical impasse for the citizen. On one side, an international publication stakes its reputation on specific documents and sources. On the other, the accused institution issues a blanket denial, and unnamed government officials, shielded by anonymity, call the documents fabricated or misattributed. Who does the public believe? In the absence of a transparent, on-the-record government press conference or an independent, dogged follow-up by the domestic press, the official denial, however vague, often wins by default.

This procedural smokescreen effectively kills the story. The debate shifts from “Did the government improperly direct public funds?” to “Are these documents authentic?”—a much harder question for under-resourced newsrooms to tackle and a much less compelling one for a public navigating daily life.

A Chilling Contrast: The Ghost of Journalism Past

To understand the significance of this silence, one need only look back a decade to the era of the United Progressive Alliance (UPA) government. Then, allegations of corruption in the 2G spectrum allocation and the coal block allocation scandals dominated the media landscape for years. News channels hosted nightly shouting matches, front pages were splashed with leaked documents, and journalists relentlessly pursued ministers and officials.

The contrast with today is stark. As commentator Sohit Misra points out, the media then saw its role as a fierce interrogator of power. Today, when faced with allegations that link the highest echelons of government with the country’s most powerful industrialist, the dominant mood is one of caution, if not outright avoidance.

This shift cannot be attributed solely to a lack of journalistic courage. It is the product of a calculated ecosystem.

- The Legal Bludgeon: Investigative journalists like Paranjoy Guha Thakurta, who have doggedly pursued the Adani story, have faced a barrage of defamation lawsuits. These legal battles are not necessarily aimed at winning in court, but at draining the time, resources, and spirit of reporters and their publishers. For large media houses, the cost-benefit analysis of pursuing such a story tilts heavily towards risk.

- Structural Pressures: The takeover of legacy media outlets, like NDTV by the Adani Group itself, sends a clear message to the industry. When a conglomerate you may need to cover critically also becomes your owner or a major potential advertiser, editorial independence faces an insidious threat. The space for critical reporting shrinks.

- The Nationalist Framing: Critical reporting on the government or its perceived allies is often swiftly re-framed as an “anti-national” act or a conspiracy by foreign forces to undermine India’s rise. The Washington Post is easily dismissed as an outsider with a biased agenda, a narrative that preemptively discredits the story without engaging with its facts.

The Real Scandal is in the Unasked Questions

Even if one discounts the Washington Post’s report as speculative or inaccurate, the failure of the mainstream media to independently investigate the core issues it raises constitutes a profound institutional failure.

The story opens up a series of critical public interest questions that remain largely unexplored:

- Due Diligence or Directive? LIC claims its investments were made after “detailed due diligence.” Given the Adani Group’s well-documented high debt levels and the volatility exposed by the Hindenburg report, what did this due diligence entail? Was the risk to policyholders’ money adequately assessed? An independent press would be dissecting LIC’s investment committee minutes and risk assessment models.

- The Nature of “National Interest”: The government’s alleged defence, as per the Post, is that supporting Adani is synonymous with supporting India’s economic ambitions. This conflation of corporate and national interest is a dangerous precedent. Should the fate of public financial institutions and taxpayer money be tied to the fortunes of a single corporate group? This philosophical and economic debate is missing from public discourse.

- The Accountability Vacuum: The story relies on a denial from LIC and whispers from unnamed officials. Where is the Finance Minister? Where is the DFS Secretary? Why is there no demand for a detailed, point-by-point rebuttal from the government, placed squarely on the record? The media’s role is to create that demand, not to accept its absence.

The Canary in the Coal Mine: A Shrinking Public Sphere

The fate of the Adani-LIC story is not an isolated incident. It is a symptom of a broader constriction of India’s public sphere. As the author Kalpana Sharma notes, the baton of hard-hitting investigative journalism has been passed to under-resourced, independent platforms like CobraPost or individual journalists on YouTube. While these platforms are vital, they lack the reach and institutional heft of the mainstream press to set the national agenda.

When the mainstream media, the traditional fourth pillar of democracy, chooses to amplify denials over investigating allegations, it creates a dangerous information asymmetry. The public is left with a sanitized, official version of events, while complex, uncomfortable truths are relegated to the margins.

The real insight from this episode is that the most potent form of censorship in today’s India may not be a dramatic crackdown, but a quiet, pervasive culture of self-censorship. It’s the unsaid understanding of which stories are worth pursuing and which are too “sensitive.” It’s the editorial calculation that leads to a headline that says “LIC Denies” instead of “Govt Accused of Steering Billions to Adani.”

In the end, the story of the Adani-LIC expose is not just about money. It is a stark reminder that the health of a democracy can be measured not by the scandals that are uncovered, but by the silence that follows. And in India today, that silence is growing deafening.

You must be logged in to post a comment.