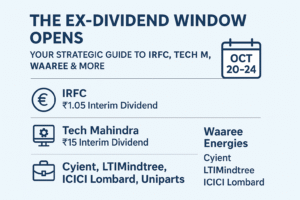

The Ex-Dividend Window Opens: Your Strategic Guide to IRFC, Tech M, Waaree & More (Oct 20-24)

The upcoming week of October 20-24, 2025, serves as a strategic checkpoint for investors as a diverse set of companies, including IRFC, Tech Mahindra, and Waaree Energies, trade ex-dividend, a date where a stock’s price is adjusted downward to reflect the upcoming dividend payout, transferring value from the company’s books to shareholders’ pockets.

This list provides more than just dates; it reveals market narratives, from the stable cash flows of established IT and insurance giants to the balanced growth-and-reward signals from renewable energy players and the notable one-time wealth transfer of a special dividend. For the astute investor, this event is less a short-term trading opportunity and more a moment to evaluate the long-term health, dividend sustainability, and strategic direction of these businesses to make informed portfolio decisions.

The Ex-Dividend Window Opens: Your Strategic Guide to IRFC, Tech M, Waaree & More (Oct 20-24)

Meta Description: A strategic deep dive into the upcoming ex-dividend week. We go beyond the list to analyze what IRFC, Tech Mahindra, Waaree Energies, and others tell us about market trends, and how to build a smart dividend strategy.

The phrase “ex-dividend” flashes across financial news feeds every week, often met with a mix of anticipation and confusion. For investors, it’s not just a date on a calendar; it’s a moment of truth that separates mere stock holders from strategic capital allocators.

The week of October 20-24, 2025, brings a fascinating cross-section of Indian companies to the ex-dividend stage, from the steady giants of infrastructure to the agile players in tech and renewable energy. But simply knowing the list is like having a map without a compass. Let’s navigate the terrain together, understanding not just the “what,” but the “so what” for your portfolio.

Demystifying the Ex-Dividend Date: More Than Just a Price Drop

Before we analyze the players, let’s solidify the concept. The ex-dividend date is the cut-off point set by stock exchanges. If you buy a stock on or after this date, you do not receive the upcoming dividend payment. That right belongs to the seller.

Think of a company’s share price as a container holding both the value of the business and the cash it’s about to pay out. On the ex-dividend date, the cash is removed from the container. Consequently, the stock price is typically adjusted downward by an amount roughly equal to the dividend per share.

Example in Action: If Tech Mahindra closes at ₹1,200 on Friday, October 17, and its interim dividend is ₹15, it will likely open around ₹1,185 on Monday, October 20 (the ex-dividend date), all other market forces being equal.

This isn’t a loss; it’s a neutral corporate action. The shareholder on record receives cash, and the company’s value on the books decreases slightly. The real skill lies in interpreting what these dividend declarations signal and how to position yourself around them.

A Week of Contrasts: Analyzing the Key Players

This week’s list isn’t a monolith. It’s a story of different sectors, strategies, and shareholder expectations.

1. The Steady Eddies: Consistent Cash Generators

- Tech Mahindra (₹15 Interim Dividend): A bellwether of the IT sector, TechM’s dividend is a sign of stable cash flow generation. For such large-cap IT firms, dividends are a way to reward shareholders while still retaining ample capital for R&D and acquisitions. The key metric to watch here isn’t just the dividend yield, but its sustainability and growth over time. A consistent payer like Tech M provides a foundation of predictable income in a portfolio.

- ICICI Lombard General Insurance (₹6.5 Interim Dividend): The insurance business is fundamentally about float – premiums collected upfront before claims are paid. This model can generate significant cash. A regular dividend from a company like ICICI Lombard signals confidence in its underwriting profitability and reserve management. It’s a play on the structural growth of insurance in India, coupled with shareholder returns.

2. The Capital-Intensive Player: Rewarding Patient Capital

- Indian Railway Finance Corporation (IRFC) (₹1.05 Interim Dividend): With a seemingly small dividend, IRFC’s story is about its role in financing the nation’s rail infrastructure. Its dividends are a testament to its unique, low-risk business model of borrowing from the market and lending to the Indian Railways. The yield, when calculated on its often low share price, can be attractive. Investors here are often betting on a combination of modest dividends and potential long-term capital appreciation driven by India’s infra push.

3. The Growth Hybrids: Sharing Success While Fueling Expansion

- Waaree Energies (₹2 Interim Dividend): This is a critical one to watch. Waaree is a leader in the red-hot solar energy space, a sector that requires massive capital expenditure for expansion. The fact that it’s declaring a dividend suggests a few things: strong current profitability, robust cash flows from existing operations, and a desire to attract a broader investor base that values returns. It’s a signal that the company is maturing, balancing the need to reinvest for explosive growth with the responsibility of rewarding its backers.

- Cyient (₹16 Interim Dividend) & LTIMindtree (₹22 Interim Dividend): Like Tech Mahindra, these IT services firms are sharing their prosperity. A healthy dividend from these companies indicates they have navigated global macroeconomic headwinds effectively and are generating free cash flow beyond their immediate operational and growth needs.

4. The Special Situation: The “Bonus” of a Large Payout

- Uniparts India Ltd (Special Dividend of ₹22.5): The term “Special Dividend” is a red flag for attention. It’s a non-recurring payout, often triggered by a one-time event—a particularly profitable period, the sale of an asset, a windfall, or a decision to distribute excess cash on the balance sheet. For Uniparts, a special dividend of this size is a significant transfer of wealth to shareholders. It’s great news for current holders, but it also raises a question: why not reinvest this capital? It could imply a lack of immediate, high-return projects, which is a nuance investors should dig into.

Beyond the Headlines: Crafting Your Dividend Strategy

Knowing the dates is step one. Building a strategy is what separates successful investors.

- The “Ex-Dividend Trap” for Traders: Short-term traders sometimes try to “capture” the dividend by buying just before the ex-date and selling after. This is often a fool’s errand. With transaction costs, taxes, and the automatic price adjustment, this strategy rarely nets a profit. The market is far too efficient for such a simple arbitrage.

- The Long-Term Investor’s Playbook: For the true dividend investor, the ex-dividend date is a non-event. Their focus is on:

- Dividend Yield: (Annual Dividend Per Share / Current Stock Price). Is it sustainable?

- Payout Ratio: (Dividends Per Share / Earnings Per Share). A ratio that is too high (e.g., over 80-90%) can be a warning that the dividend is not sustainable, as the company isn’t retaining enough earnings for growth or safety nets.

- Track Record: Has the company maintained or grown its dividend through economic cycles? Consistency is king.

- Business Health: Is the company in a growing industry with a durable competitive advantage? A dividend is only as strong as the business behind it.

- The Power of Reinvestment: The magic of compounding isn’t just about stock price; it’s about dividends too. Using dividends to buy more shares (a DRIP or Dividend Reinvestment Plan) can dramatically accelerate wealth creation over decades.

The Final Tally: A Week of Opportunity and Education

The week of October 20-24 offers a microcosm of the Indian stock market. From the steady cash flows of IT and insurance to the growth-funded rewards of renewables and the one-time boon from special situations, there’s a narrative for every type of investor.

Your takeaway shouldn’t be to blindly buy these stocks before they go ex-dividend. Instead, use this list as a starting point for research. Does a high-yielding, capital-intensive company like IRFC fit your risk profile? Does Waaree’s dividend signal a maturity that aligns with your growth-and-income goals? Does Uniparts’ special dividend warrant a deeper look into its future plans?

The ex-dividend date is a financial checkpoint. It’s a reminder that investing is ultimately about owning a share in a business—and sometimes, those businesses share their profits directly with you. Your job is to ensure you’re owning the right ones.

Disclaimer: This article is for informational and educational purposes only. It does not constitute a recommendation to buy or sell any securities. Please consult with a qualified financial advisor before making any investment decisions.

You must be logged in to post a comment.