Tejas Networks News : Tejas Networks Soars on BSNL Project, Analysts Raise Target Price 21% (Buy)

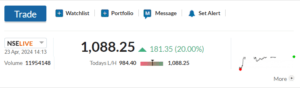

In a recent report published on April 23, 2024, Emkay Global Financial expressed optimism for Tejas Networks. Their recommendation is to buy the stock, with a target price set at Rs 1,100 per share.

- Tejas Networks exceeded revenue and margin expectations, driven by BSNL’s 4G project.

- They benefit from the Indian government’s push for domestic manufacturing (PLI scheme), large investments in BSNL, BharatNet, and Railways, potential new clients through references from TCom and TCS, and the global shift away from Chinese telecom equipment.

- Analysts expect Tejas Networks’ revenue in FY25 to be 4 times higher than FY24 due to BSNL and BharatNet projects.

- They are raising their revenue estimates for FY25 and FY26 by 6-7% due to the strong performance.

- EBITDA margin is also being raised by 150 basis points on the back of the margin beat.

Analysts are bullish on Tejas Networks and have increased their target price to Rs 1,100 per share, representing a potential upside of 21% compared to their previous target of Rs 975. This revised target price is based on a discounted cash flow (DCF) valuation with a weighted average cost of capital (WACC) of 10.5% and a terminal growth rate of 6%. They maintain a buy rating on the stock.

![Unprecedented Early Voting Turnout: Will It Break Records or Fall Short? [Report: 368,309 Early Votes in Bexar County]](https://timeswordle.com/wp-content/uploads/2024/11/Unprecedented-Early-Voting-Turnout-Will-It-Break-Records-or-Fall-Short-Report-368309-Early-Votes-in-Bexar-County.png)