Shadowfax IPO: A Deep Dive into the Logistics Unicorn Making Your Deliveries Possible

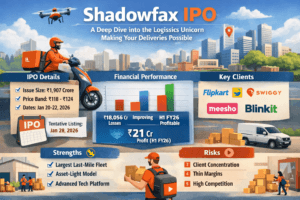

The Shadowfax Technologies IPO, opening for subscription from January 20-22, 2026 with a price band of ₹118-124, aims to raise ₹1,907 crore to fund the expansion of its critical last-mile and hyperlocal delivery network, which powers deliveries for major platforms like Flipkart, Swiggy, and Zomato. While the company demonstrates impressive scale—covering over 14,000 pin codes—and a strong financial turnaround to profitability, with H1 FY26 profits of ₹21 crore on ₹1,805 crore revenue, it operates in a brutally competitive industry characterized by razor-thin margins and faces significant concentration risk, as nearly half its revenue depends on its single largest client. Ultimately, the IPO presents a direct bet on the continued growth of India’s e-commerce ecosystem, but investors must weigh the company’s market leadership and scalable tech platform against the persistent challenges of low profitability and client dependency inherent in the logistics sector.

Shadowfax IPO: A Deep Dive into the Logistics Unicorn Making Your Deliveries Possible

- IPO Essentials: Shadowfax aims to raise ₹1,907 crore with shares priced between ₹118-₹124, opening from January 20-22, 2026.

- Financial Turnaround: The company has pivoted from heavy losses to profitability, with H1 FY26 profits at ₹21 crore on ₹1,805 crore revenue.

- Business Model & Risks: Its asset-light, tech-driven model serves e-commerce giants but faces thin margins and heavy client concentration.

From your latest e-commerce parcel to the hot meal delivered during peak hours, there’s a high chance that Shadowfax Technologies, a logistics unicorn, orchestrated the final leg of that journey. As this key player in India’s delivery ecosystem opens its ₹1,907 crore Initial Public Offering (IPO) for subscription, it presents a pivotal moment for investors to gauge the value—and the vulnerabilities—of the invisible infrastructure powering the country’s digital commerce boom.

The Engine Behind Your Online Orders

Founded in 2015 by Abhishek Bansal and Vaibhav Khandelwal, Shadowfax operates as a technology-led, third-party logistics (3PL) provider. Its core business is solving the most complex part of shipping: the last-mile and hyperlocal delivery. The company operates an asset-light model, leveraging a vast, crowdsourced network of over two lakh delivery partners instead of owning a massive fleet. This allows it to scale rapidly to meet fluctuating demand.

The company’s success is underpinned by its extensive operational scale. It covers an impressive 14,758 pin codes with more than 4,299 operational touchpoints across India, including sort centres and delivery hubs. Its proprietary technology platform handles everything from intelligent routing and real-time tracking to automated payouts, ensuring efficiency at scale.

A Diversified Yet Concentrated Clientele

Shadowfax serves a who’s who of India’s digital economy. Its clients include major platforms like Flipkart (which is also an early investor), Meesho, Swiggy, Zomato, and Uber, along with quick-commerce specialists like Blinkit and Zepto. CEO Abhishek Bansal has stated a strategic focus on diversifying further into serving Direct-to-Consumer (D2C) brands and smaller retailers. However, a significant risk remains: in the first half of FY26, a single largest client contributed 49% of its revenue, and the top ten clients made up 84%. Any major shift in business from one of these anchors could substantially impact its finances.

A Financial Snapshot: Growth and Thin Margins

Shadowfax’s financials narrate a classic growth-to-profitability story typical of tech-led startups.

Table: Shadowfax Technologies Financial Performance (₹ in Crore)

| Financial Period | Revenue from Operations | Profit After Tax (PAT) | EBITDA Margin |

| FY 2023 | 14,151.24 | (1,426.38) | (7.18%) |

| FY 2024 | 18,848.22 | (118.82) | 1.02% |

| FY 2025 | 24,851.31 | 64.26 | 1.96% |

| H1 FY 2026 | 18,056.44 | 210.37 | 2.86% |

The data shows a remarkable trajectory: the company has steadily grown revenue while making a decisive pivot from significant losses to profitability. For the first half of FY26 alone, its revenue matched the entirety of FY24, and profit showed a healthy jump. This performance is largely driven by India’s booming e-commerce and quick commerce sectors.

However, the numbers also reveal the inherent challenge of the logistics industry: razor-thin margins. Despite massive revenues, Shadowfax’s EBITDA margin, while improving, remains below 3%. This highlights a sector where efficiency at scale is not just an advantage but a necessity for survival.

Inside the IPO: Structure, Use of Funds, and Valuation

The public offering is a mix of fresh capital for the company and an exit opportunity for its early backers.

IPO Structure & Key Dates

- Total Issue Size: ₹1,907.27 Crore

- Fresh Issue: ₹1,000 Crore (proceeds to the company)

- Offer for Sale (OFS): ₹907.27 Crore (proceeds to selling shareholders like Flipkart, Eight Roads, and IFC)

- Price Band: ₹118 to ₹124 per equity share

- Minimum Lot Size: 120 shares (₹14,160 – ₹14,880)

- Subscription Window: January 20 to January 22, 2026

- Tentative Listing Date: January 28, 2026

Where Will the Fresh Capital Go?

The ₹1,000 crore raised by the company is earmarked for aggressive growth:

- ~42% (₹423 Cr): Capital expenditure for network infrastructure.

- ~14% (₹139 Cr): Lease payments for new first-mile, last-mile, and sort centres.

- ~9% (₹89 Cr): Branding, marketing, and communication.

- ~35% (₹349 Cr): Unidentified inorganic acquisitions and general corporate purposes.

Valuation and Market Sentiment

At the upper price band of ₹124, Shadowfax is valued at approximately ₹7,168 crore on a post-money basis. This is notably lower than earlier targeted valuations of ₹8,500-9,000 crore, which may reflect a more realistic assessment of market conditions. Ahead of the IPO, the company secured a strong vote of confidence by raising ₹856 crore from anchor investors, including major domestic mutual funds (ICICI Prudential, Nippon India) and global institutions like Norges Bank, at the upper price band.

The Grey Market Premium (GMP), an unofficial indicator of market demand, was around ₹9-10, suggesting an expected listing premium of roughly 7-8%.

Investment Thesis: Weighing the Opportunity Against the Risks

Investing in the Shadowfax IPO is ultimately a bet on the structural, long-term growth of India’s digital consumption and Shadowfax’s ability to out-execute rivals in a cut-throat market.

Table: Key Strengths vs. Critical Risks for Investors

| Strengths (The Bull Case) | Risks (The Bear Case) |

| Market Leadership: Largest crowdsourced last-mile fleet in 3PL; strong in high-growth hyperlocal/quick commerce. | Client Concentration: Heavy reliance on a few large clients for most revenue. |

| Scalable Tech Platform: Proprietary systems for routing, tracking, and partner management provide an efficiency moat. | Thin & Volatile Margins: Highly competitive industry with low single-digit EBITDA margins; seasonal demand spikes create inefficiencies. |

| Asset-Light Model: Allows for capital-efficient expansion without the burden of owning heavy assets. | Execution & Regulatory Risks: Scaling network carries operational risk; regulatory changes for gig workers could impact costs and model. |

| Profitability Trajectory: Clear financial turnaround from losses to consistent profits with improving margins. | High Valuation: P/E ratio is not yet meaningful; valuation must be justified by sustained high growth. |

Questions for Potential Investors

- Growth vs. Profitability: Can Shadowfax continue its rapid revenue growth while steadily improving its thin margins in a price-sensitive industry?

- Diversification Timeline: How quickly and effectively can the company reduce its dependence on its top 2-3 clients by onboarding more D2C and mid-market businesses?

- Competitive Moat: Is its technology and network advantage strong enough to withstand competition from both established players like Delhivery and new entrants?

The Final Takeaway: A Growth Story with Training Wheels

The Shadowfax IPO arrives at an inflection point for the company and the sector it operates in. It offers a pure-play investment into the essential, yet often overlooked, logistics backbone of India’s digital economy. The company has demonstrated an impressive ability to scale, achieve profitability, and attract blue-chip investors.

For long-term, growth-oriented investors with a higher risk tolerance, Shadowfax represents a chance to invest in a critical enabler of India’s e-commerce narrative. Its success is tightly coupled with the continued expansion of online retail and quick commerce.

Conversely, more conservative investors may find the combination of elevated valuation, client concentration risk, and industry-thin margins a reason for caution. Watching the company’s post-listing performance, particularly its progress in client diversification and margin stability, could provide a clearer picture.

In essence, when your doorbell rings with the next delivery, the company behind it is stepping out of the shadows and into the spotlight of the public markets. Whether it seizes this opportunity will depend on its execution in the challenging but promising miles ahead.

What is the single biggest factor you believe will determine Shadowfax’s success as a public company—its ability to diversify its client base, improve its profit margins, or defend its market share from competitors? The path it chooses will define its journey on the stock exchange.

You must be logged in to post a comment.