Reliance News : Focus on O2C performance: Reliance Q1 Profit Up Despite Chemical Headwinds, O2C Business Boosted by Strong Margins

The core business of Reliance Industries, oil and chemicals, saw a profit increase in the last quarter of fiscal year 2024, contributing to the company’s earnings growth.

Reliance News: Reliance’s oil and chemicals business saw a strong increase in revenue during the first quarter of 2024. Revenue grew by 10.9% compared to the same period last year, reaching ₹1.42 lakh crore. This is up from ₹1.29 lakh crore in Q1 2023.

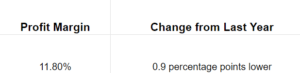

Reliance’s oil and chemicals business profitability grew slightly in Q1 2024. Their quarterly EBITDA reached ₹16,777 crore, which is a 3% increase year-over-year compared to ₹16,293 crore in the first quarter of 2023.

Reliance News: Mukesh Ambani credited the O2C segment’s performance to favorable market conditions. He explained that high global demand for fuels, coupled with limitations in refining capacity worldwide, helped maintain profit margins for Reliance’s oil and chemicals business.

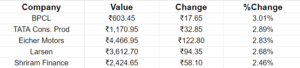

Reliance Industries faced headwinds in their downstream chemical business during the year, according to Mukesh Ambani. However, the company’s overall performance remained positive. Their consolidated net profit for Q1 2024 was ₹18,951 crore, slightly lower than the previous year’s ₹19,299 crore. This decrease was offset by a strong revenue increase of ₹2.4 lakh crore compared to ₹2.13 lakh crore in the same period last year. This revenue growth was driven by double-digit growth in both their oil & chemicals (O2C) and consumer businesses. Reflecting this positive performance, the board approved a second dividend of ₹10 per share for the 2024 financial year.

A Sharekhan analyst, Binod Modi, explained the improvement in Reliance’s O2C business margin. He attributed it to two factors:

- Higher GRMs (Gross Refining Margins): This suggests that Reliance was able to sell its refined products at a higher profit during the quarter.

- No maintenance shutdowns: Avoiding these shutdowns likely allowed Reliance to maintain higher production levels and capitalize on favorable market conditions.

These factors, according to Modi, were expected to contribute to positive margins for the O2C segment this quarter. The paraphrase omits the information about the stock price since it’s not directly related to the analyst’s comments on the O2C business margin.

You must be logged in to post a comment.