Raymond Soaring: Demerger to Unlock Hidden Value? (Buy Before It Splits?)

Raymond splits into textiles & real estate arms. Stock jumps, analysts see further gains. Buy now for potential pre-split windfall?

CONTENTS: Raymond Soaring: Demerger to Unlock Hidden Value?

- Prepare for Raymond’s demerger impact

- Raymond stock shows strong potential

- Raymond poised for continued growth

Prepare for Raymond’s demerger impact

Raymond Soaring: Demerger to Unlock Hidden Value?

Raymond announced a plan to split into separate textile and real estate units, with the latter to be listed independently. This move, approved by their board, involves shareholders receiving shares of Raymond Realty in proportion to their holdings in Raymond.

The real estate segment contributed 24% of Raymond’s FY24 revenue. The company now awaits approvals from shareholders, the National Company Law Tribunal (NCLT), and other authorities before setting a record date for the demerger.

Considering this development, here’s a summarized trading strategy based on the charts:

Raymond stock shows strong potential

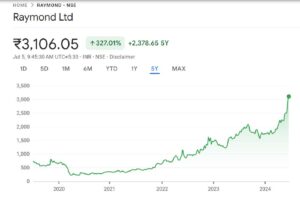

Raymond’s stock closed at Rs 2,940 recently, with analysts predicting a potential upside of 23.5%. Key support levels are identified at Rs 2,862, Rs 2,780, and Rs 2,700, while resistance is noted at Rs 3,173.

The stock has surged significantly, increasing by 65% after breaking through trend line resistance on the weekly chart in mid-April. Over the past seven months, Raymond has risen by 109%, trading within a range of Rs 1,488 to Rs 3,150.

Raymond poised for continued growth

From a technical perspective, despite being in overbought territory, Raymond’s price-to-moving averages and momentum oscillators indicate a favorable setup for the stock.

According to the weekly chart analysis, the uptrend is likely to continue as long as Raymond maintains above the upper Bollinger Band, currently at Rs 2,862 on a closing basis. Strong support levels are observed at Rs 2,780 and Rs 2,700.

Resistance is identified at Rs 3,173, with potential for further gains if the stock surpasses this level. Targets for upward movement include Rs 3,350, Rs 3,490, and Rs 3,630 within the current quarter.

Check out TimesWordle.com for all the latest news

You must be logged in to post a comment.