Market Pulse: Decoding a Cautious Session Filled with Corporate Catalysts

Market Pulse: Decoding a Cautious Session Filled with Corporate Catalysts

The Indian equity markets opened on a cautious note this Monday, with investor attention divided between several significant corporate developments and a broader environment of sectoral weakness. Amidst news of major contracts, strategic integrations, and block deals, the benchmark indices struggled for direction, reflecting the market’s attempt to price in these micro catalysts against a backdrop of macroeconomic signals.

Market Snapshot: A Tug of War Between News and Sentiment

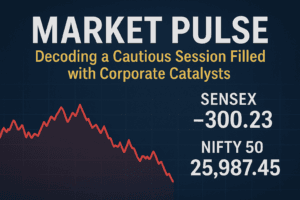

As of late morning on December 8, 2025, the market mood was measured. The Sensex was trading over 300 points lower, while the Nifty 50 index hovered below the 26,100 mark. The weakness was broad-based, with the midcap and smallcap indices also in the red, declining by 0.2% and 0.5% respectively. Sectorally, realty stocks were among the hardest hit, with the Nifty Realty index down 2%, snapping a two-day winning run. Other sectors like auto, banking, and FMCG also showed softness, with only the IT sector displaying pockets of resilience.

This cautious sentiment played out even for stocks that announced positive news. For instance, shares of RailTel Corporation traded flat despite the company winning a ₹14.4 crore international order from the Ministry of External Affairs for AI-enabled laptops. Similarly, Bharat Dynamics (BDL) was trading down nearly 4% at ₹1,454.10, continuing a recent corrective phase from its 52-week high.

Thematic Drivers: Contracts, Consolidation, and Capital

The day’s trading was influenced by news flows across several key themes. The table below summarizes the major corporate actions that were in focus:

| Company | Key Development | Financial Implication / Context |

| Biocon | Strategic integration of subsidiary Biocon Biologics; FDA tentative approval for Parkinson’s drug. | Values Biocon Biologics at $5.5 billion; aims for completion by March 2026. |

| Zen Technologies | Received a ₹120 crore contract from the Ministry of Defence. | To set up India’s first Combat Training Node (CTN) in Madhya Pradesh. |

| HFCL | Secured export orders worth ₹656.10 crore ($72.96 million) for optical fiber cables. | Order secured through overseas subsidiary from an international customer. |

| Ashoka Buildcon | Received additional work on a Mumbai flyover project from BMC. | Additional scope valued at ₹447.21 cr, total project cost now ₹1,573.79 cr. |

| ITC Hotels | Block deal: BAT affiliates sold a 9% stake for nearly ₹3,856 crore. | HCL Capital was the largest buyer, acquiring nearly a 7% stake. |

Defence & Infrastructure: Order Wins Amidst Volatility

Companies linked to defence and infrastructure projects announced significant order inflows, though stock reactions were mixed. Beyond Zen Technologies’ major defence contract, Cochin Shipyard signed contracts to build four electric tugs for Svitzer, with deliveries starting late 2027. MTAR Technologies also received a ₹194 crore order from a new customer in the civil nuclear power sector.

In the infrastructure space, SPML Infra received a ₹207.38 crore water project in Rajasthan under the Jal Jeevan Mission. However, a fundamental analysis of SPML Infra reveals concerning metrics. The stock is considered overvalued with poor fundamentals and high debt. Its consolidated debt-to-equity ratio, while improved, averaged 2.45 over the past three years, and a significant 27.11% of promoter shares are pledged. This highlights a critical insight for investors: a contract announcement does not automatically override pre-existing fundamental weaknesses in a company’s financial health.

Corporate Restructuring & Capital Markets Activity

Strategic corporate actions signaled long-term planning. The most significant was Biocon’s move to fully integrate its biosimilars subsidiary, Biocon Biologics, through a share swap. Reports also indicated the company has picked bankers for a potential capital raise of up to ₹4,500 crore.

In the capital markets, ICICI Bank’s subsidiary, ICICI Prudential AMC, filed its Draft Red Herring Prospectus (DRHP) for a ₹10,603 crore IPO, set to hit the market later in the week. The SME segment saw activity with Invicta Diagnostic listing at a 17.65% premium on the NSE Emerge platform. The company, which runs diagnostic centres under the brand PC Diagnostics, plans to use IPO proceeds to set up five new centres in Maharashtra.

Stocks Under Pressure: The Other Side of the Story

While several stocks were in focus for positive reasons, others faced selling pressure due to broader market weakness or company-specific concerns.

- PSU and Realty Stocks: The Nifty PSU Bank and Realty indices were notable underperformers. This dragged down stocks across these sectors.

- Bharat Dynamics (BDL): The defence PSU was down sharply despite a strong longer-term performance (still up ~23% year-on-year). The decline reflects profit-booking at elevated valuations, with the stock trading at a high TTM P/E ratio of 82.01.

- Kaynes Technology: The stock continued its sharp decline, down nearly 19% over three days following a broker report flagging concerns over financial disclosures and related-party transactions.

Investor Insight: Looking Beyond the Headlines

The trading session of December 8 presents a classic case study in market dynamics. Positive company-specific news is necessary but not always sufficient to drive stock prices higher in the short term. The broader market sentiment, sectoral trends, and the underlying financial health of a company play equally decisive roles.

For investors, days like these underscore the importance of a dual-layer analysis:

- Catalyst Tracking: Monitoring operational developments like order wins, regulatory approvals, and strategic deals.

- Fundamental Grounding: Continuously assessing valuation, debt levels, profitability trends, and corporate governance practices. The contrasting narratives of a new contract for SPML Infra and its leveraged balance sheet perfectly illustrate this point.

The market’s tepid response to seemingly positive news in stocks like RailTel or BDL suggests that after a strong rally in specific segments, valuations are under the microscope. Investors are becoming more selective, rewarding only those developments that significantly alter a company’s long-term earnings trajectory or are achieved by firms with clean balance sheets and transparent governance.

As the market digests these micro developments, the overarching themes of government capex (defence, infrastructure), corporate consolidation, and sectoral rotation remain the powerful currents guiding capital allocation. Navigating this environment successfully will depend on separating transient noise from genuine, value-accretive change.

You must be logged in to post a comment.