Key Dividend Opportunities: What Investors Need to Know (Aug 6, 2025)

Eight key listed companies—including Coal India, Blue Dart, Dr Lal PathLabs, and Kirloskar Industries—trade ex-dividend Wednesday (August 6). To qualify for payouts, investors must hold shares by end-of-day Tuesday. Coal India leads with an interim ₹5.50/share dividend, while Blue Dart offers a substantial ₹25/share final dividend. Healthcare player Dr Lal PathLabs (₹6/share) and industrial heavyweight Kirloskar Industries (₹13/share) also feature prominently.

Note that stock prices typically adjust downward on ex-dates reflecting the dividend amount—this isn’t a loss but a market correction. Separately, earnings reports from Bajaj Auto and Hero MotoCorp may influence sector sentiment. Investors should verify dividend sustainability through payout ratios and sector health rather than chasing yields alone.

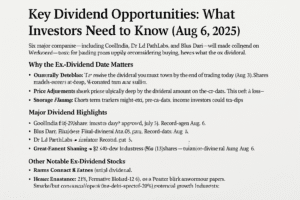

Key Dividend Opportunities: What Investors Need to Know (Aug 6, 2025)

Six major companies—including Coal India, Dr Lal PathLabs, and Blue Dart—will trade ex-dividend on Wednesday. If you’re holding these stocks or considering buying, here’s what the ex-dividend date means for your portfolio:

Why the Ex-Dividend Date Matters

- Ownership Deadline: To receive the dividend, you must own shares by the end of trading today (Aug 5). Shares bought tomorrow (Aug 6) onward will not qualify.

- Price Adjustment: Stock prices typically drop by the dividend amount on the ex-date. This isn’t a loss—it’s a market recalibration.

- Strategic Timing: Short-term traders might exit pre-ex-date; income investors could see dips as buying opportunities.

Major Dividend Highlights

Coal India (₹5.50/share):

- Interim dividend approved July 31. Record date: Aug 6.

- Insight: Consistent dividends reflect stable cash flows in the coal sector despite energy transition debates.

Blue Dart (₹25/share):

- Final dividend (face value ₹10/share). Record date: Aug 6.

- Why it stands out: A high per-share payout signals strong logistics demand and robust earnings.

Dr Lal PathLabs (₹6/share):

- Interim dividend (face value ₹10/share). Record date: Aug 6.

- Context: Healthcare stocks remain resilient; dividends highlight steady post-pandemic performance.

Great Eastern Shipping (₹7.20/share) & Kirloskar Industries (₹13/share):

- Both turn ex-dividend Aug 6.

- Note: Shipping dividends often correlate with global trade cycles, while Kirloskar’s reflects diversified industrial strength.

Other Notable Ex-Dividend Stocks

- Ramco Cements: ₹2/share (final dividend).

- Smaller but Consistent Payers:

- Hester Biosciences (₹7), Fermenta Biotech (₹2.5), Bajaj Auto-linked Rajratan Global Wire (₹2).

- Watch: Micro-caps like Adf Foods (₹0.6) – smaller dividends but potential growth indicators.

Broader Market Context

- Earnings Reports Due: Bajaj Auto, Hero MotoCorp, Pidilite, and Trent announce quarterly results Wednesday. Dividend stocks’ performance may be influenced by sectoral earnings sentiment.

- Market Mood: Sensex fell 0.38% Tuesday amid global tariff concerns. Dividend stocks can offer defensive positioning during volatility.

3 Strategic Considerations for Investors

- Dividend Yield ≠ Total Return:

Calculate yield (dividend/share ÷ current price). E.g., Blue Dart’s ₹25 dividend at ₹7,500/share = 0.33% yield—assess if this aligns with income goals.

- Tax Efficiency:

Dividends are taxed at your income slab rate. Factor this into net returns.

- Sustainability Check:

High dividends are attractive, but verify payout ratios (dividends/net income). A ratio >80% may be unsustainable long-term.

Wednesday’s ex-dividend wave offers income opportunities but demands selectivity. Prioritize companies with:

- History of sustainable payouts (e.g., Coal India).

- Strong sector tailwinds (e.g., healthcare, logistics).

- Healthy balance sheets (low debt, stable cash flow).

Always cross-reference dividends with broader fundamentals and earnings trends. When in doubt, consult a SEBI-registered advisor.

You must be logged in to post a comment.