Kaynes Tech’s Open Interest Explosion: A Signal of Sustained Rally or a Peak in the Making?

The significant 19.06% surge in open interest for Kaynes Technology India Ltd, coupled with its strong price trend and robust fundamentals—including explosive sales growth, a debt-free balance sheet, and its strategic position in India’s manufacturing boom—paints a compelling picture of a high-quality company attracting intense market speculation.

However, this bullish momentum is starkly contrasted by severe valuation concerns, with a Price-to-Book Value of 17 and a high PEG ratio, and a critical red flag from promoters who significantly reduced their stake, suggesting the stock may be priced for perfection and that the current frenzy presents a high-risk scenario where the potential for a sharp correction is as pronounced as the opportunity for further gains.

Kaynes Tech’s Open Interest Explosion: A Signal of Sustained Rally or a Peak in the Making?

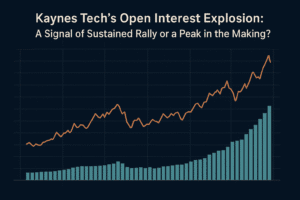

The derivatives market is often where the smart money leaves its footprints, and for Kaynes Technology India Ltd, those footprints have turned into a stampede. On October 7, 2025, this mid-cap industrial manufacturing player reported a staggering 19.06% surge in open interest (OI), catapulting it to 24,525 contracts. This isn’t just a random blip on the radar; it’s a loud signal that demands a closer look. Coupled with a hefty trading volume of 48,441 contracts, the stock is clearly at the center of a fierce tussle between bulls and bears.

But for the discerning investor, the real question is: Is this surge a prelude to a sustained breakout or a warning sign of an impending correction? To answer that, we need to move beyond the headline numbers and delve into the multi-faceted story of Kaynes Tech.

Decoding the Derby: What Surging Open Interest Really Tells Us

First, let’s demystify the jargon. Open Interest (OI) represents the total number of active derivative contracts (like futures and options) that haven’t been settled. A rise in OI, especially when accompanied by a price increase (as seen with Kaynes’ 2.10% gain and proximity to its 52-week high), is traditionally interpreted as bullish sentiment. It signifies that new money is flowing into the market, and participants are building new long positions, anticipating further upside.

The volume of 48,441 contracts, more than double the OI, indicates incredibly high activity and liquidity. This isn’t a sleepy stock being nudged; it’s a battleground where significant positions are being taken. The fact that the stock is trading above all its key moving averages (5-day to 200-day) paints a picture of a powerful, unwavering uptrend. The technical setup, in isolation, is nearly perfect.

The Bull Case: More Than Just Hype – A Fundamentally Strong Engine

The bullish argument for Kaynes Tech isn’t built on charts alone. The underlying business fundamentals provide a compelling narrative.

- The “Atmanirbhar Bharat” Powerhouse: Kaynes Technology is a critical player in India’s electronics system design and manufacturing (ESDM) sector. As the government’s Production Linked Incentive (PLI) schemes catalyze a domestic manufacturing revolution, companies like Kaynes are at the epicenter. They are no longer just a contract manufacturer; they are a strategic partner in the nation’s push for self-reliance in electronics, serving sectors from automotive to aerospace.

- Explosive Financial Growth: The numbers speak for themselves. With net sales growing at an annual rate of 53.69% and operating profit at 56.88% over the long term, Kaynes is in a hyper-growth phase. The latest six-month data reinforces this, with PAT growing at 44.51%. This isn’t a company being valued on mere potential; it’s delivering staggering growth quarter after quarter.

- Robust Liquidity and Delivery: The 99.97% surge in delivery volume compared to its five-day average is a critical data point. “Delivery” means investors are actually taking physical delivery of the shares, not just squaring off intraday trades. This signals strong conviction and long-term holding intent from a segment of the market, moving beyond speculative day-trading.

- A Fortress Balance Sheet: In an era where debt has crippled many promising companies, Kaynes stands out with a negligible Debt-to-Equity ratio. This provides immense financial flexibility to navigate economic cycles, invest in new capacities, and avoid the crippling burden of interest costs.

The Bear Case and The Red Flags: Navigating the Valuation Minefield

However, no investment thesis is complete without a rigorous examination of the risks. The “Mojo Score” analysis provides crucial counterpoints that cannot be ignored.

- The Valuation Conundrum: This is the single biggest concern. With a Return on Equity (ROE) of 10.3, the stock is trading at a staggering Price-to-Book Value of 17. This is undeniably in the “very expensive” territory. The PEG ratio (Price/Earnings to Growth) of 3.45 is another red flag. A PEG above 1 often suggests a stock may be overvalued relative to its earnings growth trajectory. While the stock has returned 33.14% in the last year, its profits grew by 51.5%, meaning a significant portion of the recent rally is driven by multiple expansion (investors willing to pay more for each rupee of earnings), not just fundamental profit growth.

- The Ominous Signal from Promoters: Perhaps the most significant cautionary tale is the action of the company’s promoters. They have decreased their stake by -4.23% in the previous quarter. Promoters are the most informed investors; their selling is never a move to be taken lightly. While there can be legitimate reasons (diversification, personal financial planning), such a substantial reduction often signals reduced confidence in the near-term prospects or a belief that the stock is fully, if not over, valued.

- The Sector’s Cyclical Nature: As an industrial manufacturing company, Kaynes is not immune to economic cycles. A broader economic slowdown could quickly dampen the euphoria and impact order flows, making its premium valuation difficult to sustain.

The Verdict: A High-Stakes Balancing Act

So, where does this leave an investor?

The surge in open interest and the powerful price trend confirm that Kaynes Technology is a high-quality company in a sweet spot, riding a powerful structural tailwind. The growth story is authentic and impressive.

However, the astronomical valuation and the promoter selling are glaring warning signs that the stock is priced for perfection. Any stumble in quarterly earnings, a delay in a major order, or a shift in market sentiment could trigger a sharp correction.

For existing investors, this might be a time to consider taking some profits off the table or implementing strict trailing stop-losses to protect gains. The risk-reward ratio is becoming increasingly skewed.

For new investors, chasing the momentum here is akin to walking a tightrope. The potential for further upside exists, but the margin of safety is thin. A more prudent strategy would be to wait for a healthy market correction or a period of consolidation to enter at a more reasonable valuation. This is a stock to keep on a very tight watchlist and study relentlessly.

Conclusion

Kaynes Technology India Ltd is a testament to India’s evolving manufacturing landscape. The explosive OI surge is a reflection of its undeniable promise. However, in the market, the greatest profits are often preserved by knowing not just what to buy, but also when to be cautious. Right now, Kaynes Tech presents a classic conflict between a stellar growth narrative and a demanding valuation. Navigating this requires not just bullish enthusiasm, but a bear’s prudence. The bulls and bears are locked in combat; the wise investor will watch from the sidelines, waiting for a clearer winner to emerge before committing their capital.

You must be logged in to post a comment.