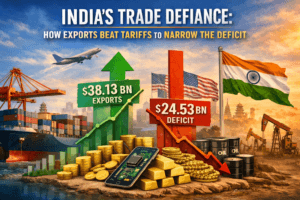

India’s Trade Defiance: How Exports Beat Tariffs to Narrow the Deficit

India’s trade deficit narrowed sharply to a five-month low of $24.53 billion in November 2025, marking a dramatic reversal from October’s record high of $41.7 billion. This improvement was driven by a robust 10.9% month-on-month surge in exports to $38.13 billion—the highest level since June 2022—led by engineering goods and electronics, coupled with a significant 17.6% drop in imports due to lower purchases of gold, oil, and coal. Notably, exports to the U.S. defied punitive tariffs by growing 10% from the previous month, aided by strategic diversification into other markets like China.

However, this strong monthly performance only provided temporary relief, as the cumulative deficit for the fiscal year remains widened, and underlying pressures on the currency and the unresolved U.S. trade deal continue to pose challenges to sustainable external sector health.

India’s Trade Defiance: How Exports Beat Tariffs to Narrow the Deficit

In an economic climate shadowed by protectionist policies, India’s latest trade data tells a story of unexpected resilience. After hitting a record high just a month prior, the country’s merchandise trade deficit narrowed sharply to $24.53 billion in November 2025—a five-month low that significantly outperformed economists’ expectations. This dramatic swing was not the result of economic retreat but of robust offensive action: goods exports surged to a 10-year high for the month of November, reaching $38.13 billion. This performance, defying steep new U.S. tariffs, signals a critical inflection point for one of the world’s fastest-growing major economies.

The Headline Numbers: A Dramatic Reversal

The contrast between October and November 2025 could not be more striking. In October, the merchandise trade deficit had ballooned to a historic $41.68 billion, as exports contracted sharply following the imposition of punitive U.S. tariffs. By November, the deficit had shrunk to $24.53 billion, a figure that was $7.5 billion better than the median forecast of $32 billion from a Reuters poll of economists.

The improvement was driven by a powerful dual engine: a 19.4% year-on-year surge in exports—the fastest growth rate since June 2022—and a simultaneous 1.9% decline in imports. On a month-to-month basis, the recovery was even more pronounced, with exports climbing 10.9% from October’s level. Commerce Secretary Rajesh Agrawal underscored the significance, noting that November’s export value was the highest for that month in over a decade and that “November has been a good month for exports”.

Export Resilience in the Face of Tariffs

The most compelling narrative from the November data is the rebound in trade with the United States. In August 2025, the U.S. administration imposed an additional 25% tariff on Indian imports, raising total duties on some goods to as high as 50%. Sectors like textiles, gems and jewellery, and marine products were hit hardest. The immediate impact was severe: exports to the U.S. fell 8.6% year-on-year in October.

November, however, told a different story. Exports to the U.S. rose 22.6% from a year earlier to $6.98 billion, and showed a nearly 10% increase from the previous month. This resilience suggests that Indian exporters and their American clients are beginning to adapt to the new tariff reality. As Secretary Agrawal stated, “India has held fort on the U.S. exports despite tariffs,” and there is a “fair expectation” that both countries will finalize a trade deal.

A crucial factor in offsetting pressure from the U.S. market has been a strategic and aggressive diversification into other key economies. Exports to China, for instance, skyrocketed by 90% year-on-year in November to $2.2 billion. This push into newer markets was a deliberate strategy highlighted by government officials.

The Import Side: Gold and Fuel Drive the Decline

While exports surged, a significant moderation in imports played an equally vital role in shrinking the trade gap. Imports in November fell to $62.66 billion from $76.06 billion in October. This decline was not broad-based but concentrated in specific, volatile categories:

- Gold: Imports plunged by 59.15% year-on-year to $4 billion. This dramatic drop is largely attributed to the passing of the festive and wedding season in India, which typically drives high gold purchases.

- Crude Oil: Imports fell by 11.27% to $14.11 billion, reflecting both price volatility and strategic inventory management.

- Coal and Coke: These imports also decreased by 5.71%.

This import moderation provided temporary but crucial relief to the trade balance. However, it also underscores a persistent vulnerability: India’s trade deficit remains structurally dependent on the prices of imported commodities like oil and gold.

Sectoral Performance: Engineering and Electronics Lead the Charge

The export recovery was led by high-value, manufactured goods, indicating a positive shift in the composition of India’s export basket. According to official data, 25 of the 30 key export sectors registered growth in November.

The table below highlights the standout performers that powered November’s export growth:

| Export Sector | Growth (Year-on-Year) | Key Insight |

| Engineering Goods | 23.76% | Remains the cornerstone of merchandise exports, demonstrating industrial competitiveness. |

| Electronic Goods | 38.96% | A major success story, driven by production-linked incentive schemes for smartphone manufacturing. |

| Gems & Jewellery | 27.80% | Showed remarkable resilience despite being a prime target of U.S. tariffs. |

| Drugs & Pharmaceuticals | 20.91% | A consistent performer, benefiting from global demand for quality generic medicines. |

| Petroleum Products | 11.65% | Reflects India’s strength as a refinery hub, exporting value-added fuel products. |

The stellar performance of electronics exports, in particular, has acted as a “shield” against trade headwinds, with sectors like smartphone manufacturing becoming a significant growth pillar.

The Bigger Picture: Services Surplus and Currency Pressures

To fully understand India’s trade health, one must look beyond merchandise to include services. India runs a massive and growing surplus in services trade, which substantially offsets the goods deficit. In November, services exports were estimated at $35.86 billion against imports of $17.96 billion, yielding a surplus of $17.9 billion. When combined with the merchandise deficit, the overall trade deficit (goods and services) narrows to just $6.64 billion.

Despite this, the economy faces significant external pressures. The Indian rupee has been under sustained depreciation pressure, breaching the psychologically significant level of 90 against the U.S. dollar in early December 2025. Analysts argue this reflects deeper structural issues, including a chronic merchandise trade deficit and dependence on foreign capital to finance it. The lack of a U.S. trade deal exacerbates this uncertainty, keeping currency markets nervous.

A Critical Look Ahead: Is the Recovery Sustainable?

While the November data provides a welcome respite, it raises critical questions about sustainability.

- A One-Month Rebound or a New Trend? Government officials have framed November as making up for October’s losses. The key will be whether exporters can maintain this momentum or if it represents a one-time adjustment to new tariffs.

- The Structural Deficit Persists. On a cumulative basis for the fiscal year (April-November 2025), the merchandise trade deficit has actually widened to $223.13 billion from $203.33 billion in the same period the previous year. November’s improvement is a positive step, but it has not reversed the annual trend.

- The Threat to Employment. High-tariff sectors like textiles and gems and jewellery are intensely labor-intensive. The Global Trade Research Initiative has projected that Indian exports to the U.S. could fall sharply in 2026, which poses a severe risk to millions of jobs.

- The Imperative of a U.S. Deal. The core tension remains unresolved. The U.S. continues to demand greater access for its agricultural products and lower Indian tariffs. Until a deal is struck, a cloud of uncertainty will hang over a crucial trade relationship.

In conclusion, India‘s November 2025 trade performance is a testament to the agility and resilience of its export community. It demonstrates an ability to absorb a significant trade shock, diversify markets, and leverage strengths in sectors like engineering and electronics. However, celebrating a single month’s data would be premature. The narrow path forward requires converting this resilience into a sustained structural shift—deepening manufacturing capabilities, securing strategic trade agreements, and reducing import dependency. The November numbers are a hopeful sign that India is holding its fort, but the long-term campaign for trade stability and strength is far from over.

You must be logged in to post a comment.