India’s Strategic Energy Pivot: The Decline of Russian Oil and a New Trade Reality

India’s Strategic Energy Pivot: The Decline of Russian Oil and a New Trade Reality

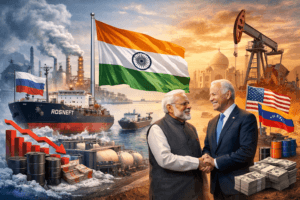

Amid high-stakes geopolitics, India’s oil import strategy is undergoing its most significant shift in years. Data from December 2025 shows crude imports from Russia fell to $2.7 billion, the lowest monthly figure since February of that year and a 27% drop from November. This decline, driven by aggressive U.S. sanctions and a new bilateral trade deal, signals more than a temporary market adjustment; it represents a fundamental recalibration of India’s energy security and geopolitical alignments. For a nation that imports nearly 89% of its crude needs, every shift in sourcing carries profound economic and strategic weight.

The Geopolitical Catalyst: U.S. Pressure and the Trade Deal

The immediate driver of India’s pivot is unambiguous: sustained pressure from the United States. The U.S. strategy has been a multi-pronged escalation. In August 2025, it imposed a 25% additional tariff on Indian goods specifically for New Delhi’s purchases of Russian oil, which, on top of existing reciprocal tariffs, brought the total levy on some Indian exports to a staggering 50%.

The pressure intensified on October 22, 2025, when the U.S. announced sanctions on Russia’s two oil giants, Rosneft and Lukoil, setting a November 21 deadline to wind down dealings. These two companies alone accounted for an estimated 60% of India’s Russian crude imports.

The breakthrough came with the announcement of a U.S.-India trade deal on February 2, 2026. President Donald Trump declared that Prime Minister Narendra Modi had agreed to stop buying Russian oil and instead purchase more from the U.S. and potentially Venezuela. In return, the punishing 50% tariff on Indian goods would be slashed to 18%. While the Modi government has been characteristically quiet on confirming the oil pledge—focusing public statements on “ensuring the energy security of 1.4 billion Indians”—the market data suggests compliance is underway.

Table: Key Timeline of U.S. Pressure and India’s Response

| Date | Event | Immediate Consequence for India |

| Aug 2025 | U.S. imposes additional 25% tariff over Russian oil buys. | Total U.S. tariffs on some Indian goods rise to 50%. |

| Oct 22, 2025 | U.S. sanctions Rosneft and Lukoil. | Indian refiners must cease dealings with Russia’s largest suppliers. |

| Nov 21, 2025 | Deadline to wind down dealings with sanctioned firms. | Imports from Russia begin sharp decline. |

| Feb 2, 2026 | U.S.-India trade deal announced. | U.S. tariffs to drop to 18%; India agrees to shift oil sourcing. |

Beyond the Headlines: The Complex Reality of “Zero” Imports

The political declaration of reducing Russian oil to “zero” is cleaner than the operational reality. Analysis suggests a more nuanced picture will emerge:

- Phased Reductions, Not an Immediate Halt: Refiners are honoring pre-sanctions commitments but are not placing new orders. Analyst firm Kpler notes that Russian volumes are largely locked in for 8-10 weeks, expecting imports to remain in the 1.1-1.3 million barrels per day range through early Q2 2026 before potentially halving.

- The Nayara Energy Exception: A critical complication is Nayara Energy, which operates India’s second-largest refinery. Rosneft owns a 49.13% stake in it, and due to its ownership structure and existing Western sanctions, it has few alternative suppliers. Sources indicate India may seek a special dispensation for Nayara to continue imports from non-sanctioned entities.

- The Rise of the “Shadow Fleet”: Sanctions rarely stop trade; they reroute it. A global “shadow fleet” of over 1,400 tankers engages in deceptive practices like ship-to-ship transfers, turning off location beacons, and flying false flags to move sanctioned oil. In December 2025 alone, 93 shadow vessels operated under false flags, with 26 delivering an estimated €0.8 billion of Russian crude this way. This network allows Russian oil to potentially continue flowing through intermediaries, obscuring its final destination.

The Search for Alternatives: Costs and Complexities

Replacing a supplier that met over 35% of India’s import needs at a steep discount is a monumental task. Each alternative comes with significant trade-offs:

- United States: Imports from the U.S. are already rising, jumping 92% from April-November 2025 compared to the same period in 2024. However, American crude (WTI) is lighter and sweeter than Russia’s medium-sour Urals blend and is more expensive, lacking the deep discount.

- Venezuela: Touted by Trump as an alternative, Venezuelan Merey crude is similarly heavy and sour but presents logistical hurdles. Venezuela is twice as far from India as Russia, raising freight costs. Its discount to Brent is also smaller ( $5-8/barrel ) compared to Urals ( $10-20/barrel ). Analysts estimate Venezuelan crude would need a $10-12/barrel deeper discount just to offset these higher costs.

- Middle East: The obvious fallback, with Iraq and Saudi Arabia already top suppliers. However, reverting to a heavy reliance on the Gulf reduces India’s bargaining power and exposes it to OPEC+ production decisions and regional instability.

The financial impact is substantial. Losing the Russian discount could add $3-4 billion to India’s annual oil import bill. For Indian refiners who reported robust margins thanks to cheap Russian crude, replacement with market-priced oil will squeeze profitability, potentially forcing higher domestic fuel prices.

Infographic: The Sanction-Busting Network (A simplified illustration of how Russian oil bypasses sanctions)

- Loading: Russian Urals crude is loaded onto a tanker at a Baltic or Black Sea port.

- “Going Dark”: The vessel turns off its AIS transponder or spoofs its location.

- Ship-to-Ship (STS) Transfer: In international waters (e.g., off Greece or in the Bay of Bengal), the oil is transferred to another vessel.

- Documentation Change: The cargo is “re-documented” as originating from a non-sanctioned location.

- Port Arrival: The second vessel arrives at an Indian port with “clean” paperwork.

The Bigger Picture: India’s Strategic Dilemma

This shift is more than a trade adjustment; it is a stress test for India’s longstanding policy of strategic autonomy. For decades, New Delhi has balanced relationships with Washington and Moscow. The forced choice between affordable energy from a traditional partner (Russia) and broader trade and strategic benefits from a new ally (the U.S.) is acute.

The deal also highlights India’s vulnerability. As one of the world’s largest oil importers, its economic stability is perennially hostage to global oil shocks. The drive for diversification—sourcing from nearly 40 countries—is a direct response to this fragility.

Global Market Implications

India’s pivot sends ripples across global energy markets:

- Russia: Losing its second-largest customer forces Moscow to offer even steeper discounts to other buyers, primarily China, further eroding the revenue funding its war effort.

- China: Beijing emerges with greater leverage as the predominant buyer of discounted Russian oil, potentially tightening its energy and political ties with Moscow.

- OPEC+: Middle Eastern producers may see increased demand from India, but a flood of deeply discounted Russian oil into the market (mostly to China) could put downward pressure on global benchmarks, complicating OPEC+ production decisions.

The Path Ahead: A Managed Rebalance

India is unlikely to fully or abruptly sever ties with Russian energy. Instead, it will pursue a managed rebalance:

- Gradual Diversification: Accelerated purchases from the U.S., the Middle East, and possibly Venezuela and West Africa.

- Quiet Workarounds: Tolerating or tacitly enabling shadow fleet operations and intermediary sales for as long as possible, especially for critical cases like Nayara Energy.

- Diplomatic Bargaining: Using the phased reduction as leverage in future negotiations with Washington, seeking technology transfers, investment, and strategic concessions.

The December 2025 import figure of $2.7 billion is not an endpoint but a marker on a new, uncertain path. It reflects the undeniable power of U.S. financial statecraft and India’s pragmatic calculus that access to Western markets and technology is, for now, more valuable than the full benefits of Russian oil discounts. The era of India as the unquestioned, top-tier buyer of sanctioned Russian crude is over. The era of a more complex, costly, and diplomatically fraught energy procurement strategy has begun. The success of this pivot will fundamentally shape India’s economic resilience and its position in the new geopolitical order.

You must be logged in to post a comment.