India’s Space Ambitions Soar: How the Record-Breaking BlueBird 6 Launch Reshapes the Global Direct-to-Device Race

India’s Space Ambitions Soar: How the Record-Breaking BlueBird 6 Launch Reshapes the Global Direct-to-Device Race

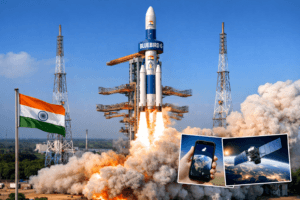

The late evening lift-off from India’s Satish Dhawan Space Centre on December 23rd was more than just another successful rocket launch. It was a vivid symbol of shifting power dynamics in the global space and telecommunications industries. As the Indian Space Research Organisation’s (ISRO) most powerful rocket, the LVM3, hurled AST SpaceMobile’s BlueBird 6 satellite into orbit, it carried with it the weight of multiple converging narratives: India’s assertive entry into the heavy-lift commercial launch market, a bold challenge to the architecture of satellite connectivity, and a tangible step toward a world where dead zones in mobile coverage are relegated to history.

The Launch: A Milestone for ISRO and a Strategic Coup for AST

The mission was a record-setter for India. At approximately 6,100 kilograms, BlueBird 6 is the heaviest commercial satellite ever launched from Indian soil on an Indian vehicle. ISRO Chairman V. Narayanan’s post-launch statement—highlighting the 434 foreign satellites launched for 34 countries—wasn’t just pride; it was a strategic market declaration. By reliably delivering payloads for giants like Eutelsat’s OneWeb and now AST SpaceMobile, ISRO is positioning the LVM3 as a cost-effective, capable alternative in a launch market constrained by Western backlog and geopolitical complexities.

For AST SpaceMobile, the choice of India as the launchpad for its first next-generation Block 2 BlueBird was a masterstroke of logistics and symbolism. It diversifies their launch dependency beyond SpaceX and the yet-to-be-proven cadence of Blue Origin’s New Glenn. More importantly, it placed their flagship technological marvel into orbit with a partner whose own space story is one of ambitious, budget-conscious innovation—a fitting parallel to AST’s goal of democratizing connectivity.

Beyond Size: The Engineering Marvel of the BlueBird 6

While headlines focus on the satellite’s mass, the real revolution is in its unfolded form. The BlueBird 6’s phased array antenna, spanning about 223 square meters, is a behemoth. To visualize, that’s larger than a professional doubles tennis court. This isn’t merely “bigger is better” engineering; it’s fundamental to AST’s disruptive thesis.

Unlike competitors like SpaceX’s Starlink, which requires a user terminal, or its emergent direct-to-smartphone service that leverages existing Starlink v2 Mini satellites with smaller antennas, AST is betting on sheer aperture size. This massive antenna allows it to connect directly to standard, unmodified 4G/5G mobile phones using standard cellular frequencies licensed from partner carriers like AT&T, Vodafone, and Rakuten. The physics are clear: a larger antenna can capture weaker signals from a handheld device on Earth and deliver stronger signals back to it, enabling a genuine “space-based cellular tower” experience.

The Block 2 upgrade is not just structural. With in-house developed chips promising 10 GHz of processing bandwidth—ten times that of its predecessors—each BlueBird 6-class satellite becomes a powerful orbital data hub capable of supporting peak rates up to 120 Mbps. This addresses a core critique of early direct-to-device services: bandwidth scarcity. AST’s architecture, relying on fewer but vastly more powerful satellites (a planned constellation of ~45-60 versus SpaceX’s thousands), aims for high capacity per spacecraft over blanket coverage, targeting service in partnership with terrestrial networks, not as a wholesale replacement.

The Gathering Storm in Direct-to-Device Connectivity

The launch accelerates a high-stakes race that is defining the next era of space-based services. The market is fragmenting into distinct architectural philosophies:

- The Mega-Constellation Leveragers (SpaceX & others): Using thousands of smaller satellites to build a dense mesh. For direct-to-device, they are adding complementary payloads (e.g., Starlink’s D2D system) to this existing backbone. The advantage is existing infrastructure and rapid scaling; the challenge is limited per-satellite phone-connecting power and potential spectrum coordination.

- The Purpose-Built Giant (AST SpaceMobile): The “quality over quantity” approach. BlueBird satellites are bespoke, high-capacity towers designed specifically for seamless integration with terrestrial mobile networks. The advantage is stronger signals and carrier partnership ease; the challenge is the immense technical and financial risk per unit, and a slower constellation build-out.

- The Hybrid & GEO Players (Lynk Global, Omnispace, etc.): Employing a mix of orbits and satellite sizes. Some are already offering basic texting services.

AST’s successful deployment of its first Block 2 satellite is a critical proof point that its radical design is launch-worthy and operable. With BlueBird 7 already shipped to Cape Canaveral and up to 25 more in various production stages, the company is betting its future on the flawless execution of this complex design at scale.

The Road Ahead: Challenges and the Human Impact

The path to global 5G-from-space is fraught with obstacles. Launch Cadence: AST’s ambitious plan for 45-60 satellites by end-2026 heavily relies on New Glenn, which, despite two successful tests, has yet to establish a regular flight rhythm. Regulatory Hurdles: Securing and coordinating spectrum nationally and internationally remains a diplomatic minefield. Economic Viability: The cost of building and launching these sophisticated giants must be offset by revenue-sharing deals with carriers, a business model still in its infancy.

Yet, the potential human impact is transformative. Imagine:

- A farmer in rural Nebraska receiving real-time weather data and video consultations directly on his phone.

- A hiker in the Andes sending an emergency SMS via their standard smartphone after a fall.

- Shipping vessels maintaining constant, low-cost connectivity for crew welfare and operational efficiency across entire oceans.

- Disaster responders establishing immediate communication in cell-tower-blackout zones.

This is the genuine value proposition: not just another subscription service for the connected elite, but the silent integration of space infrastructure into the global mobile grid, making connectivity an ambient, reliable utility.

Conclusion: A Defining Moment in the New Space Ecosystem

The LVM3’s plume over Sriharikota marked more than a satellite delivery. It signaled India’s arrival as a full-spectrum launch provider capable of catering to the most demanding commercial missions. For AST SpaceMobile, it was the moment its grand vision—once confined to prototypes and presentations—began its real-world test in the harsh environment of space.

The direct-to-device battle will be won not just by who launches first, but by who best balances technological elegance, regulatory savvy, and partnership ecosystems. With BlueBird 6 now on station, the industry watches closely. Its performance will either validate the paradigm of fewer, mightier satellites or underscore the immense difficulty of the path AST has chosen. One thing is certain: the race to connect every pocket of the planet just entered a new, dramatically more interesting phase.

You must be logged in to post a comment.