India’s Iran Trade: A Strategic Balancing Act in the Shadow of US Tariffs

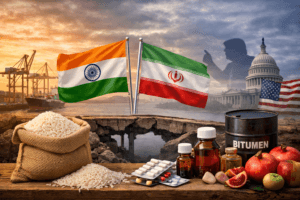

In response to former US President Donald Trump’s threat of a 25% tariff on nations trading with Iran, Indian officials have highlighted that bilateral commerce is now “minuscule” and primarily humanitarian, posing minimal economic risk. This follows India’s pivotal 2019 decision to cease all Iranian oil imports due to US sanctions, which collapsed total trade from a peak of $17 billion to just $1.68 billion—a mere 0.15% of India’s global trade.

Today, exports consist almost entirely of essential food and pharmaceuticals like rice and medicines for Iranian citizens, while imports are negligible. Officials argue that any new US tariffs would have limited direct impact, as the greater threat to trade is Iran’s own collapsing economy and currency, which is already stifling payments and reducing purchasing power. The situation underscores India’s delicate geopolitical balancing act, maintaining a bare-minimum, principled link with Iran while actively insulating its far more critical strategic and trade partnership with the United States from disruption.

India’s Iran Trade: A Strategic Balancing Act in the Shadow of US Tariffs

The recent social media pronouncement from former US President Donald Trump, threatening a 25% tariff on any nation doing business with Iran, sent ripples through global diplomatic and trade circles. For India, a nation historically navigating a complex path between Washington’s strategic partnerships and West Asia’s entrenched relationships, the immediate question was one of exposure. The resounding answer from officials and trade data, however, suggests not a crisis, but a calculated and diminished economic link, refined by years of prior sanctions into a channel of bare essentials.

The “Minuscule” Trade: A Relationship Deliberately Diminished

Indian officials were quick to characterize bilateral trade with Iran as “minuscule,” and the numbers bear this out. With total trade in FY 2024-25 standing at $1.68 billion—a mere 0.15% of India’s global trade—Iran doesn’t even rank among India’s top 50 trading partners. This is a staggering decline from the pre-2019 era, when trade peaked at $17.03 billion in 2018-19, buoyed almost entirely by Indian imports of Iranian crude oil.

The pivotal moment came in May 2019, when India, following the Trump administration’s withdrawal from the Iran nuclear deal and the re-imposition of strict sanctions, ceased all oil imports from Tehran. This was a significant strategic concession, underscoring the priority of the India-US relationship. The result was a near-total collapse of the trade volume, stripping it down to its current skeletal framework.

What’s Left: A Humanitarian Corridor of Food and Medicine

The composition of today’s India-Iran trade reveals its carefully circumscribed nature. Indian exports, which totalled $1.24 billion in FY 2024-25, are overwhelmingly essential commodities. Basmati rice alone constitutes the lion’s share, with shipments worth $468 million in the first eight months of FY 2025-26. This is followed by other life-sustaining goods: tea, pharmaceuticals (bulk drugs and formulations), pulses, sugar, and fresh fruits.

As one official noted, these are supplies “essential for inflation-ravaged Iranian citizens.” This is not trade in strategic materials, dual-use technology, or infrastructure projects. It is, in essence, a humanitarian corridor sustained despite payment hurdles through mechanisms like rupee-rial arrangements and limited banking channels. Imports from Iran have similarly dwindled, now consisting mainly of fresh fruits and some non-sanctioned petroleum products, like bitumen.

The US Tariff Threat: Calculated Risk and Minimal Direct Impact

The architecture of Trump’s proposed tariff—a 25% levy on all business with the US for countries engaging with Iran—appears designed for maximum coercive effect. However, for India, the direct economic impact is assessed as minimal for two key reasons.

First, the sheer asymmetry of trade relationships. India’s trade with the United States dwarfs that with Iran by over two orders of magnitude. In FY 2024, US-India bilateral trade exceeded $118 billion. Jeopardizing this for a $1.68 billion relationship is an implausible calculus. Second, officials point out that the specifics of any executive order will be critical. The implication is that essential, humanitarian trade may potentially be exempted or treated with nuance, a view echoed by the Federation of Indian Export Organisations (FIEO).

Furthermore, Indian goods already face significant tariffs in the US market, including the additional 25% levy imposed in 2024 over India’s continued purchases of Russian oil. The incremental burden, therefore, on an already diminished export flow to Iran, is viewed as a manageable business risk rather than a national economic threat.

The Real Pain: Iran’s Crumbling Economy and Indian Exporters’ Dues

The greater insight from this situation lies not in potential US tariffs, but in the stark reality of the Iranian market itself. Indian officials and exporters reveal a more pressing concern: the collapsing purchasing power of ordinary Iranians. Soaring inflation and a currency at “historic lows,” as noted by FIEO, mean Iranian buyers are increasingly unable to pay for even essential Indian goods.

“The trade is expected to go down further,” an official stated, not because of Trump’s tweets, but due to these “external economic factors.” A second source highlighted that several Indian exporters have halted new shipments due to unpaid old dues. The trade is shrinking organically because the customer is broke. This human dimension—the plight of Iranian citizens and the financial strain on Indian SMEs exporting to them—is the untold story beneath the geopolitical headlines.

The Geopolitical Chessboard: India’s Delicate Diplomatic Balance

Beyond the economics, this episode illuminates India’s continuing diplomatic tightrope walk. External Affairs Minister S. Jaishankar’s call with US Secretary of State Marco Rubio, occurring amidst the tariff news, focused on strengthening pillars of the partnership: trade, critical minerals, defence, and nuclear cooperation. The conversation signalled a commitment to insulating the broader, strategic relationship from single-issue disruptions.

Simultaneously, India maintains a principled, if now minimal, link with Iran. This is driven by several factors:

- Humanitarian Commitment: A refusal to collectively punish a population for its regime’s actions.

- Strategic Geography: Iran remains a key node in India’s connectivity ambitions towards Central Asia and Russia via the International North-South Transport Corridor (INSTC).

- Regional Balance: As a third person pointed out, other regional players like China, Iraq, the UAE, and Turkey have significant, often oil-based, trade with Iran. India’s current profile is comparatively modest and defensible.

Looking Ahead: A Relationship in Suspended Animation

The trajectory of India-Iran trade is one of managed decline, now accelerated by Iran’s internal economic collapse. The US tariff threat, while jarring, primarily serves as a political signal to New Delhi and other global capitals. For India, the path is clear: continue to nurture the indispensable partnership with the US while retaining a vestigial, principled economic link to Iran focused purely on civilian essentials.

The real test will come if a future US administration demands the complete severing of even this humanitarian trade. Until then, India’s approach reflects a mature, realist foreign policy—one that prioritizes strategic interests without entirely abandoning a nation’s populace to isolation. The story of India-Iran trade is no longer one of oil tankers, but of rice sacks and medicine boxes, moving along a narrow and increasingly precarious bridge, with geopolitical storms raging on either side.

You must be logged in to post a comment.