India’s Consumption Crossroads: How HUL Sees “Massive Opportunities” in a Three-Tiered Market

Hindustan Unilever (HUL) and its parent company Unilever see “massive opportunities” in India’s complex consumer market, which they view as a three-tiered economy consisting of a premium-affluent class, a vast middle segment trading up to branded goods, and a price-sensitive but aspirational base. Their optimism follows strong GDP growth and GST rate cuts, which are expected to boost disposable income after a period of high food inflation dampened consumption.

To capitalize on this, HUL is executing a de-averaged strategy called “Winning in Many Indias 2.0,” which tailors products—from affordable small packs to premium innovations—and marketing for each segment. This approach aims to harness resilient rural demand, navigate short-term GST transition impacts, and counter intensifying competition by focusing on volume-led growth that aligns with India’s economic expansion.

India’s Consumption Crossroads: How HUL Sees “Massive Opportunities” in a Three-Tiered Market

India’s economic story is increasingly told through the lens of its consumer. In a recent high-profile statement, Fernando Fernandez, CEO of Unilever, declared India a land of “massive opportunities,” citing strong GDP growth and recent GST reductions as key tailwinds. This bullish outlook comes after a period where double-digit food inflation significantly impacted consumption. For its Indian subsidiary, Hindustan Unilever (HUL)—a company woven into the daily fabric of millions of households—this moment represents more than a recovery; it is a strategic inflection point to harness the spending power of a nation whose population embodies three distinct economies in one.

A Market of Many Layers: The Three-Tiered Opportunity

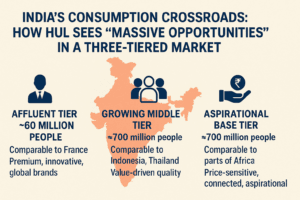

Fernandez’s optimism is rooted in a nuanced understanding of India’s unique economic pyramid. He breaks the market into three compelling tiers, each representing a distinct stage of consumer evolution and a specific strategic challenge:

- An Affluent Tier (≈60 million people): With a per capita income comparable to France, this segment drives demand for premium, innovative, and global brands.

- A Growing Middle Tier (≈700 million people): With incomes akin to Southeast Asian nations like Indonesia and Thailand, this vast group is trading up from unbranded to branded goods and seeking value-driven quality.

- An Aspirational Base Tier (≈700 million people): With incomes similar to parts of Africa, this segment is highly price-sensitive but increasingly connected and aspirational, representing the volume frontier.

This structure means a uniform strategy is futile. Winning requires a de-averaged approach, a concept HUL has formalized in its “Winning in Many Indias 2.0” (WiMI 2.0) strategy. The goal is to tailor everything from product formulation and pack size to marketing messaging and channel strategy for each agglomeration of cities and villages.

| Consumer Segment (Approx. Size) | Income Benchmark | Primary Growth Driver | HUL’s Strategic Focus |

| Affluent Tier (~60M) | Comparable to France | Premiumization & Innovation | “Future Core” & “Market Makers” portfolios; unmissable brand superiority. |

| Growing Middle Tier (~700M) | Comparable to Indonesia, Thailand | Brand Adoption & Trading-Up | Modernizing the “Core” portfolio; winning in Channels of the Future (e-commerce, modern trade). |

| Aspirational Base Tier (~700M) | Comparable to East/West Africa | Volume & Penetration | Affordable small-pack offerings; deep rural distribution; leveraging government stimulus benefits. |

Navigating the Present: GST Winds and Rural Resilience

HUL’s immediate reality is shaped by two powerful, simultaneous forces: a transient regulatory impact and a fundamental shift in demand geography.

The recent rationalization of GST rates, while a long-term booster for disposable income, created short-term channel disruption. In its Q2 FY2025 results, HUL reported a “transitory impact” of this transition, noting it specifically moderated growth in Hair Care and Personal Care segments as trade channels adjusted stocks. NielsenIQ data confirms this was an industry-wide phenomenon, with Home & Personal Care (HPC) volumes slowing in Q3 2025. HUL’s leadership, however, views this as a temporary speed bump. CEO Priya Nair stated they anticipated “normal trading conditions” by early November, paving the way for a gradual recovery. This aligns with Unilever’s top-level view that the GST reduction—affecting 40% of HUL’s portfolio—will have a “very, very significant” positive impact on the overall economy.

Concurrently, the engine of FMCG growth has moved. For the seventh consecutive quarter, rural volume growth has outpaced urban, with rural markets growing at 7.7% versus 3.7% in urban areas in Q3 2025. This rural resilience, coupled with government income support, is creating a powerful volume lever. HUL’s focus on “maximising organisational growth” through portfolio segmentation is designed to capture this demand, whether through core products in rural India or premium brands in metropolitan areas.

The Strategic Blueprint: Focus, Excel, Accelerate

To capture the three-tiered opportunity, HUL is executing a clear, three-pronged strategic framework: Focus, Excel, and Accelerate.

- Focus – Portfolio Segmentation:HUL is moving beyond a one-size-fits-all portfolio by categorizing brands into three streams:

- Core: Foundational brands like Lux or Rin that are being kept “contemporary and healthy” to retain their vast user base.

- Future Core: Aspirational brands like Dove or premium skincare that are used to “upgrade consumers” at the sweet spot of premiumization.

- Market Makers: Innovations designed to create entirely new segments, such as its ingestible skincare supplement OZiva, which saw “triple-digit growth”.

- Excel – Pivoting Investments:HUL is channeling resources into five key demand drivers. Two are particularly critical for the current context:

- Unmissable Brand Superiority: In a crowded market, winning requires superior consumer experiences. HUL’s launches, like the perfume-first Comfort Perfume Deluxe fabric conditioner, exemplify this push for discernible premium quality.

- Winning in Many Indias (WiMI 2.0): This is the operationalization of the de-averaging strategy, ensuring local relevance at a granular level.

- Accelerate – Leveraging Technology:The final pillar is about speed and efficiency. HUL is “stepping up technology and AI” across its value chain to drive revenue, generate savings, and build resilience. This spans from “digitised distributive trade” to optimize last-mile logistics, to using AI for hyper-personalized marketing and demand forecasting.

Portfolio in Action: Premiumization and Market Making

This strategy is evident in HUL’s recent market moves, which showcase a balance between strengthening the core and betting on the future.

In Beauty & Wellbeing, while mass-market Hair Care saw a GST-impacted slowdown, the Skin Care and Health & Wellbeing units grew robustly. The launch of Pond’s Hydra Miracle Ultralight Biome moisturiser and Vaseline Cloud Soft targets the premium skincare enthusiast, while the success of OZiva taps into the booming health-conscious, “inside-out” beauty trend. Similarly, in Personal Care, the relaunch of the heritage brand Pears with refreshed packaging and the expansion of the Lux International range are deliberate plays to keep core brands relevant while elevating their positioning.

The Home Care segment demonstrates volume-led strength, with Fabric Wash growing in mid-single digits, fueled by liquids. Here, innovation like Comfort Perfume Deluxe is not just a new product; it’s an attempt to redefine the fabric conditioner category from a functional commodity to an affordable luxury and self-expression tool.

The Digital and Competitive Imperative

HUL’s vision cannot be realized without mastering the digital landscape, where consumer discovery, brand building, and commerce are rapidly converging. Its digital strategy is a “finely tuned orchestra,” balancing centralized tech and data platforms with decentralized, brand-specific creative execution. Key focus areas include:

- Social-First Demand Generation: Embedding brands into culture using data-driven insights, moving beyond simple advertising to creating cultural conversations.

- E-commerce and Quick Commerce (Q-Commerce) Leadership: HUL is investing heavily to be a category captain in these “Channels of the Future”. With q-commerce changing habits (some consumers now use them for full basket purchases, not just top-ups), optimizing assortments for 10-minute delivery is a new frontier.

- Direct-to-Consumer (D2C) Experiments: While traditional channels dominate, building direct relationships through brand websites and platforms is a growing priority for rich first-party data and premium engagement.

The competitive landscape is intensifying. P&G India’s CMO calls India a “marketer’s paradise” in 2025, emphasizing that winning is now about deep consumer trust and personalized solutions, not just share. P&G leverages AI to mine insights for products like a dermatologically-tested bikini razor, born from specific consumer dissatisfaction data. Similarly, Nestlé India’s new CMD is betting on “technology, mega brands, and premium bets” to drive volume, highlighting a sector-wide pivot towards agility and premiumization. The rise of agile D2C brands and small manufacturers, who are currently outpacing large players in driving consumption growth, adds further pressure for incumbents to innovate.

The Path Forward: Volume-Led Growth in a Dynamic India

Unilever’s leadership has given HUL a clear mission: to align its volume growth with India’s GDP growth. Achieving this means successfully navigating the three-tiered consumer landscape by simultaneously:

- Stimulating the Base: Leveraging macroeconomic benefits like GST cuts to improve affordability and penetration in the aspirational segment.

- Consolidating the Middle: Winning the loyalty of the massive middle tier through superior brand experiences and seamless omnichannel availability.

- Inspiring the Top: Continuously innovating and premiumizing to capture the spending of the affluent, who set trends for the tiers below.

The “massive opportunities” Fernandez sees are real, but they are not low-hanging fruit. They require the operational precision of WiMI 2.0, the brand-building prowess to command a premium, and the digital agility to compete with both global rivals and local disruptors. For HUL, the opportunity is not just in India’s growth statistics, but in its unique ability to serve a nation where a consumer in a Mumbai high-rise and one in a Bihar village live in parallel economic realities, yet are united by common, growing aspirations. The company that can effectively bridge these worlds will not just benefit from India’s growth—it will help define it.

You must be logged in to post a comment.