India’s Compressor Industry Expands Amid Growing Demand and ‘Make in India’ Push

India’s compressor manufacturing industry is experiencing rapid growth, projected to reach ₹10,000 crores by 2025 with a 6.2% annual growth rate. Leading companies like Indo-Air Compressors and ELGi Equipments are expanding to meet increasing demand. However, challenges such as technological gaps and global competition persist. The ‘Make in India’ initiative is playing a crucial role in boosting domestic production and reducing reliance on imports. With rising industrial needs, the sector is set for significant expansion, fostering innovation and self-sufficiency in India’s manufacturing landscape.

India’s Compressor Industry Expands Amid Growing Demand and ‘Make in India’ Push

India’s compressor manufacturing sector is booming, with experts predicting it will reach a staggering ₹10,000 crores in value by 2025. This growth, fueled by a steady annual rate of 6.2%, reflects rising demand across industries such as construction, automotive, healthcare, and refrigeration. As the economy expands and infrastructure projects multiply, the need for efficient air compressors—used in everything from powering tools to cooling systems—has skyrocketed. Leading companies such as Indo-Air Compressors and ELGi Equipments are at the forefront of this expansion, scaling up production and innovating to stay ahead.

Why the Sudden Growth?

The surge in demand isn’t accidental. Rapid urbanization, government investments in infrastructure, and the push for industrial automation have created the ideal environment for compressor manufacturers. For instance, the automotive industry relies heavily on compressors for painting, assembly lines, and air conditioning systems. Similarly, the healthcare sector depends on specialized compressors for oxygen supply and medical equipment. Companies like ELGi, a Coimbatore-based leader, have capitalized on these opportunities by diversifying their product range and improving energy-efficient models. ELGi’s global footprint—exporting to over 120 countries—highlights India’s growing reputation in this field.

Big Players Stepping Up

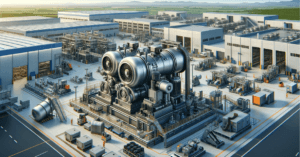

To keep pace with demand, major firms are investing heavily in new facilities, technology, and workforce training. Indo-Air Compressors, for example, has expanded its production units in Gujarat and Maharashtra, focusing on customizable solutions for small and medium enterprises. Meanwhile, ELGi opened a state-of-the-art facility in Tamil Nadu in 2022, aiming to double its export capacity. These companies aren’t just increasing output—they’re also adopting smart manufacturing practices, such as IoT-enabled compressors that monitor performance in real time, reducing downtime for clients.

Hurdles on the Road

Despite the optimism, challenges persist. A significant gap in advanced technology and R&D investment places Indian manufacturers at a disadvantage compared to global giants like Atlas Copco (Sweden) and Ingersoll Rand (USA). Many domestic companies still rely on imported components, which raises costs and complicates supply chains. Additionally, fluctuating raw material prices and the need for skilled labor strain profitability. Smaller players, in particular, struggle to compete with multinational corporations offering cutting-edge, cost-effective solutions.

The Global Competition Factor

International brands have long dominated India’s premium compressor market due to their superior technology and well-established reputations. This forces local manufacturers to either innovate rapidly or risk losing market share. However, the tide is turning. Indian firms are now partnering with global tech providers to upgrade their machinery and adopt sustainable practices. For instance, ELGi’s “oil-free” compressors, which reduce environmental impact, are gaining traction worldwide.

How ‘Make in India’ is Making a Difference

The government’s ‘Make in India’ initiative has been a game-changer. Launched in 2014, the program encourages domestic manufacturing through tax incentives, streamlined regulations, and subsidies for local sourcing. This has attracted foreign investment—companies like Siemens and Hitachi have set up compressor plants in India, creating jobs and transferring expertise. Additionally, policies promoting renewable energy have spurred demand for compressors used in solar and wind power systems.

The push for self-reliance is yielding results. According to industry reports, India’s compressor imports dropped by nearly 18% between 2020 and 2023, while exports have increased. Indian-made compressors are now being shipped to markets in Africa, Southeast Asia, and the Middle East.

The Road Ahead

To sustain this momentum, the industry must address its weaknesses. Bridging the technology gap through collaborations with research institutions and investing in automation will be crucial. Training programs for engineers and technicians can help build a skilled workforce capable of handling advanced machinery. Moreover, adopting greener technologies—such as compressors powered by renewable energy—will align with global sustainability trends and open new markets.

In conclusion, India’s compressor industry is on an upward trajectory, driven by robust demand and supportive policies. While challenges like global competition and innovation gaps remain, the sector’s proactive approach and government backing indicate a future where India is not just meeting domestic needs but emerging as a global hub for compressor manufacturing. With a continued focus on R&D and sustainability, the next decade could see the country breathing new life into this vital industry.

You must be logged in to post a comment.