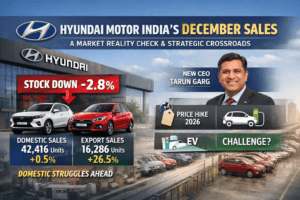

Hyundai Motor India’s December Sales: A Market Reality Check and Strategic Crossroads

Hyundai Motor India’s stock declined in early January 2026 despite reporting a 6.6% year-on-year increase in total December 2025 sales to 58,702 units, as the growth fell short of market expectations and revealed a troubling split in performance: domestic sales were nearly flat at just 0.5% growth (42,416 units), while exports surged 26.5% (16,286 units). This stagnation in its core Indian market, combined with the recent announcement of a minor price hike and a landmark leadership transition with Tarun Garg becoming the first Indian CEO, prompted investor concern over near-term domestic challenges and future strategy, leading to a correction in the share price even as the company’s role as a global export hub strengthened.

Hyundai Motor India’s December Sales: A Market Reality Check and Strategic Crossroads

Hyundai Motor India’s stock, which had enjoyed a strong run-up throughout much of 2025, faced a sharp reality check as trading opened on the first business day of 2026. Despite announcing a year-on-year increase in total sales for December 2025, the company’s shares slid as much as 2.8%, hitting an over one-month low. This seemingly paradoxical reaction—a stock decline on the back of reported growth—unpacks a more complex story of missed market expectations, a stark contrast between domestic and export performance, and a company at a strategic inflection point under new leadership.

December 2025 Sales: The Numbers Behind the Drop

On the surface, Hyundai Motor India’s (HMIL) December sales report contained positive figures. The automaker reported total sales of 58,702 units, marking a 6.6% increase from the 55,078 units sold in December 2024. This growth, however, fell significantly short of the market’s anticipation. Analysts and investors had been expecting a much stronger performance, with estimates penciling in a 13% year-on-year surge to approximately 62,667 units.

The real story lies in the breakdown of those numbers. The modest overall growth was entirely propped up by a booming export business, which masked profound weakness in the domestic market.

- Domestic Market Stagnation: Sales within India stood at 42,416 units, a marginal increase of just 0.5% compared to December 2024. This near-flat growth reflects muted consumer demand and intense competition in the local passenger vehicle sector.

- Export Engine Firing: In stark contrast, the company’s export volume jumped an impressive 26.5% year-on-year to 16,286 units. This robust performance underscores HMIL’s growing role as a global export hub for its parent company, fulfilling its stated “Made-in-India, Made-for-the-World” objective.

The table below summarizes this critical divergence in performance:

| Segment | December 2025 Units | Year-on-Year Growth | Key Insight |

| Total Sales | 58,702 | +6.6% | Growth missed market expectations of +13%. |

| Domestic Sales | 42,416 | +0.5% | Reflects stagnant local demand and high competitive pressure. |

| Export Sales | 16,286 | +26.5% | Strong growth highlights India’s role as a global manufacturing hub. |

A Triple Whammy: Sales, Prices, and Leadership

The market’s negative reaction was not based on sales data alone. The December sales announcement coincided with two other significant developments, creating a triple whammy for investor sentiment.

- Announcement of a Price Hike: Just days before the sales report, HMIL announced it would implement a weighted average price increase (WAPI) of 0.6% across its model range, effective January 1, 2026. The company attributed this move to rising input costs for precious metals and commodities. While the hike is minor and part of an industry-wide trend, it introduces a potential headwind for domestic volume growth in a price-sensitive market, especially when demand is already soft.

- A Landmark Leadership Transition: December also marked a historic change in the company’s top management. Tarun Garg assumed the role of Managing Director and CEO effective January 1, 2026. Garg, formerly of Maruti Suzuki, is the first Indian national to lead HMIL in its nearly three-decade history in India. While this is strategically viewed as a positive long-term move for localization and deeper market understanding, any leadership change introduces a period of uncertainty as the market waits to see the new executive’s strategy and execution.

Strategic Implications and the Road Ahead

The December sales data and the subsequent stock movement point to several strategic crossroads for Hyundai Motor India.

- The Domestic Challenge: The flat domestic sales are a clear warning signal. The company is facing intensifying competition from rivals like Mahindra & Mahindra, Tata Motors, and Maruti Suzuki, all of which are launching aggressive new models. Success will hinge on innovative marketing, sustained brand strength, and perhaps most importantly, a compelling electric vehicle (EV) strategy to capture the next wave of growth.

- The Export Opportunity: The stellar export performance is HMIL’s standout strength. A 26.5% growth in this segment demonstrates the quality and global appeal of its “Made in India” products. Leveraging India as a cost-effective export hub for specific models can provide a vital counterbalance to domestic cyclicality and improve overall plant utilization.

- The New CEO’s In-Tray: Tarun Garg’s vision to accelerate HMIL’s “transformation towards sustainable growth and technological leadership” will be immediately tested. His priorities will likely include reigniting domestic growth momentum, steering the company’s EV transition, and integrating HMIL more closely with Hyundai’s global electrification and technology goals. Analysts view his appointment as signaling a stronger push toward localization in decision-making, which could make the company more agile.

Market Performance and Investor Perspective

The stock’s decline to around ₹2,246 – ₹2,275 on January 2 placed it at its lowest level since November 20, 2025. This pullback also means the stock is down roughly 21% from its post-listing high of ₹2,890, despite gaining 27% over the course of 2025. This correction suggests the market is reassessing HMIL’s growth premium in light of near-term domestic challenges.

Analysts maintain a cautiously optimistic long-term view. Prashanth Tapase of Mehta Equities notes that the company remains “fundamentally strong with a resilient business model,” highlighting its best-in-class SUV portfolio and strong brand recall as key assets. The focus is now on how the new management navigates the competitive landscape to convert these strengths into sustained market share and profitability.

Conclusion

Hyundai Motor India’s December 2025 sales report served as a mirror, reflecting both the company’s formidable strengths and its immediate vulnerabilities. While its strategic position as a global export powerhouse is stronger than ever, its core domestic market is showing signs of strain. The market’s negative reaction was a disciplined response to this mixed picture and the associated near-term uncertainties of price hikes and leadership transition. For investors and observers, HMIL’s journey in 2026 will be a compelling case study in how a market leader manages transition, balances domestic and international priorities, and reinvigorates growth under a historic new captain. The road ahead for Tarun Garg and his team is clear: leverage the export wind, but reignite the domestic fire.

You must be logged in to post a comment.