E-Waste Crisis: 5 Shocking Truths Behind India’s Recycling War and Corporate Backlash

India’s e-waste crisis, surging by 72% in five years to 1.75 million metric tons, faces a critical juncture as corporate giants like Havells, Voltas, and Daikin challenge government-mandated recycling rules. The dispute centers on price-controlled EPR (Extended Producer Responsibility) certificates, introduced to formalize recycling by linking costs to environmental penalties.

Producers argue the fixed rates (30-100% of penalty fees) are arbitrary, while recyclers—dependent on certificate sales—warn of collapse without pricing safeguards. With only 21% of e-waste processed formally, informal sectors dominate, often using hazardous methods. The Delhi High Court’s pending verdict could make or break India’s ambition to extract precious metals from waste, reduce import bills, and curb environmental harm.

A ruling against the policy risks stalling recycling infrastructure and perpetuating toxic dumping, while upholding it may strain corporate profits but drive long-term sustainability. The clash underscores the tension between market freedom and environmental accountability in tackling one of India’s fastest-growing waste challenges.

E-Waste Crisis: 5 Shocking Truths Behind India’s Recycling War and Corporate Backlash

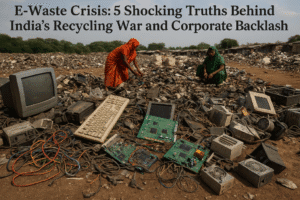

India’s dream of transforming its e-waste into a resource-rich “e-wonderland” is facing a corporate revolt. With electronic waste surging by 72% in five years—equivalent to the weight of 324,000 adult elephants—the country’s ambitious recycling vision is at a crossroads. At the heart of the conflict lies a legal battle between electronics giants and the government over new recycling regulations, exposing the fragile balance between environmental accountability and corporate interests.

Mountains of E-Waste, Dwindling Accountability

India generates 1.75 million metric tonnes of e-waste annually, yet only a third is responsibly recycled. The rest leaks into informal networks or landfills, leaching toxins into soil and groundwater. Prime Minister Narendra Modi’s plan to extract precious metals like gold, copper, and rare earth minerals from discarded electronics aims to curb import dependency while addressing environmental harm. But progress is stalling as major brands, including Havells, Voltas, and Daikin, challenge government-mandated recycling rules in court.

The EPR Certificate Standoff

In March 2024, the Environment Ministry introduced price controls for Extended Producer Responsibility (EPR) certificates—a system requiring manufacturers to fund recycling through credits. These certificates, previously traded at market rates, now have floors and ceilings tied to environmental compensation fines (30–100% of penalty rates). For instance, consumer electronics companies must pay between ₹22–₹74/kg for certificates, while IT equipment rates reach ₹112/kg.

Producers’ Argument:

- Brands claim the government lacks legal authority to fix prices, calling the rules “arbitrary” and unrelated to environmental goals.

- Industry bodies like CEAMA argue recycling costs (₹6–₹20/kg) are far lower than mandated rates, urging market-driven pricing.

Recyclers’ Reality:

- Organized recyclers, handling just 21% of e-waste, rely on EPR certificate sales for profitability. Recovered metals alone barely cover costs (₹17/kg for consumer electronics vs. ₹22/kg govt floor).

- “Without EPR credits, recycling isn’t viable,” admits a facility manager. Informal sectors dominate, often using hazardous methods to undercut formal players.

Inside a Recycling Plant: Treasure Hunt in Trash

A visit to a Uttarakhand facility reveals the painstaking process:

- Sorting: Devices are inspected; some refurbished, others dismantled.

- Dismantling: Motors, compressors, and circuit boards are extracted.

- Recovery: Shredders and furnaces reclaim metals—copper from motors, trace gold from circuit boards.

- Certification: Sales of recovered materials generate EPR credits on the CPCB portal.

Yet, profits hinge on certificate sales. “Formal recyclers can’t compete with informal sectors selling cheap, unregulated metals,” explains a worker.

Legal Stalemate, Environmental Risk

With producers withholding EPR purchases amid ongoing litigation, recyclers report a 75% drop in credit sales. The CPCB defends price controls as necessary to stabilize the recycling economy and attract investment. However, manufacturers counter that inflexible rates stifle innovation and burden compliance.

Stakes of the Battle:

- Environment: Delays risk perpetuating toxic dumping and missed recycling targets.

- Economy: India’s import bill for precious metals (₹1.15 lakh crore annually) could soar without efficient extraction.

- Industry: Formal recyclers fear collapse if the court scraps price supports, cementing informal dominance.

The Path Ahead

The Delhi High Court’s ruling will shape India’s ability to harness its e-waste potential. A producer victory might unravel price controls, favoring corporate budgets over systemic recycling growth. Conversely, upholding regulations could strain manufacturer margins but drive long-term infrastructure investment.

As Shivnarayan Rajpurohit reports, the clash underscores a global dilemma: Can economies balance profit and planet in the race to manage digital waste? For India, the answer will determine whether its e-waste dream becomes a sustainable reality or remains a toxic mirage.

Insight: The struggle reflects broader tensions in environmental governance—regulation versus market freedom, formal versus informal economies. Without compromise, India’s e-waste crisis risks becoming a cautionary tale of good intentions derailed by corporate resistance.

You must be logged in to post a comment.