Defense Stock Soars 161% in a Year – Analysts Predict Even MORE Gains (Target: ₹310!)

BEL shares surged 8% to a new high on impressive Q4 earnings. The company is well positioned to benefit from the defense indigenisation push and analysts are bullish with buy ratings and target price hikes of up to Rs 310 per share.

CONTENTS: Defense Stock Soars 161% in a Year

- BEL Q4 results impress

- BEL positioned for defense push

- BEL: Strong financials, diversification

- Motilal Oswal Upgrades BEL to Buy

- Brokerages Bullish on BEL

- BEL: Strong Growth, Target Price Hikes

BEL Q4 results impress

– Defense Stock Soars 161% in a Year

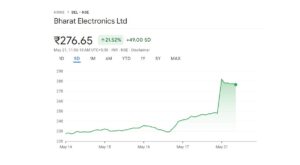

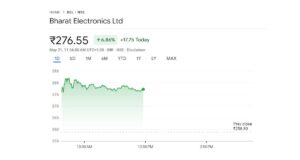

On May 21, Bharat Electronics Ltd (BEL) saw its shares surge by 8 percent to reach a new record high of Rs 283 each on the NSE, following the release of their quarterly earnings report. The state-owned company posted impressive results for the quarter ending in March 2024, exceeding market expectations due to strong revenue growth, better-than-anticipated EBITDA margins, and a higher profit after tax (PAT).

The company reported a 30 percent year-on-year increase in consolidated net profit, reaching Rs 1,797 crore, while revenue from operations soared by 32 percent to Rs 8,564 crore. The overall order inflows also surpassed expectations, contributing to the strong financial performance.

BEL positioned for defense push

Analysts at Motilal Oswal predict that Bharat Electronics Ltd (BEL) will significantly benefit from the potential Rs 5 lakh crore defense indigenisation initiative over the next five years. BEL’s extensive portfolio includes defense platforms and products such as radars, simulators, electronic warfare systems, electronic fuses, thermal imaging, integrated air command and control systems, border surveillance systems, and counter-drone systems, positioning it well to capitalize on this opportunity.

BEL: Strong financials, diversification

The indigenisation share in India’s defense sector has been steadily increasing, and the brokerage anticipates BEL’s revenue market share to remain high, around 12-13 percent. “BEL is actively working to boost its export and non-defense revenue, reducing its reliance on domestic defense contracts,” according to Motilal Oswal analysts. They also foresee BEL’s operating and free cash flows remaining robust from FY24 to FY26, thanks to effective working capital management. Additionally, BEL had a cash surplus of Rs 11,000 crore as of FY24, which supports potential capacity expansion.

Motilal Oswal Upgrades BEL to Buy

The brokerage has upgraded Bharat Electronics Ltd (BEL) to a ‘buy’ from ‘neutral’ and raised the target price to Rs 310 per share.

BEL, a Navratna PSU under the Ministry of Defence, Government of India, manufactures advanced electronic products for the Indian Army. The company received orders worth Rs 30,000 crore in FY24, surpassing its initial guidance of Rs 20,000 crore. In February, the defense ministry signed a Rs 2,269 crore contract with BEL to procure 11 Shakti warfare systems and related equipment.

Analysts at Nomura are optimistic about BEL, expecting sustained growth driven by its market dominance and increasing project sizes as the company advances as a system integrator.

Brokerages Bullish on BEL

The foreign brokerage firm has maintained its ‘buy’ rating on Bharat Electronics Ltd (BEL). They value the stock at 40 times the FY26 forecasted EPS of INR 7.4, setting a target price of Rs 300. Currently, the stock trades at a P/E ratio of 42x and 35x for FY25 and FY26 EPS, respectively. At 10:20 am, BEL shares were up 7.8 percent at Rs 278.65 on the NSE. Over the past year, the defense stock has surged by 161 percent, more than doubling investors’ wealth, and has gained over 40 percent in 2024 alone.

Jefferies has also maintained a ‘buy’ rating on BEL, projecting that the stock will rally to Rs 305 per share within the next 12 months.

BEL: Strong Growth, Target Price Hikes

The international brokerage firm also raised its target price to Rs 305 per share, suggesting an 18 percent potential upside from the stock’s closing levels on May 18. Jefferies analysts anticipate double-digit revenue growth for BEL from FY24 to FY26, driven by the company’s robust order book and pipeline. They also believe that strong margins will sustain profitability.

Morgan Stanley has given BEL an ‘overweight’ rating, raising its target price to Rs 300 per share. The brokerage expects some operational efficiencies to persist and has increased its EBITDA margin estimates to 24-24.5 percent, up from the previous 22.5-23 percent.

Check out TimesWordle.com for all the latest news

You must be logged in to post a comment.