BSE Stock Plummets Over 5% as Goldman Sachs Slashes Target Price Amid SEBI’s Regulatory Shakeup

BSE Ltd. shares fell over 5% on March 3, 2025, after Goldman Sachs slashed its target price from ₹5,650 to ₹4,880, citing concerns over SEBI’s proposed regulatory changes. These changes could significantly impact proprietary trading, which currently accounts for nearly 70% of BSE’s daily turnover. SEBI’s new framework aims to shift the calculation of open interest (OI) in equity derivatives to a future-equivalent or delta-based method, potentially reducing industry trading volumes.

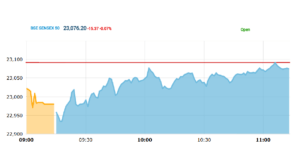

Goldman Sachs expects this shift to lower the options premium-to-cash equity turnover ratio from 0.4x to 0.3x, which could limit trading activity. Adding to investor concerns, legal troubles for BSE officials have emerged, with an FIR ordered against former SEBI and BSE executives over alleged irregularities. BSE’s stock has been on a sharp decline since February 20, plunging over 26% in six trading sessions, including a nearly 16% drop in the last two days alone. Despite this recent weakness, the stock has delivered a 92% gain in the past year and a multibagger return of 548% over three years.

However, Goldman Sachs has also lowered its earnings estimates for BSE, reducing its projected EPS for FY26, FY27, and FY28 by up to 14%. With regulatory and legal uncertainties looming, market participants are closely watching SEBI’s final decision, as it could have long-term implications for BSE’s trading volumes and stock performance.

BSE Stock Plummets Over 5% as Goldman Sachs Slashes Target Price Amid SEBI’s Regulatory Shakeup

BSE Ltd. shares experienced a sharp decline of over 5% on March 3, 2025, following Goldman Sachs’ decision to reduce the stock’s target price from ₹5,650 to ₹4,880. The downgrade was driven by concerns over the Securities and Exchange Board of India’s (SEBI) proposed regulatory changes, which could have a significant impact on proprietary trading—a major driver of BSE’s trading volumes. Despite a 97% increase in stock value over the past year, recent regulatory uncertainties and legal issues surrounding BSE officials have raised concerns among investors, leading to a substantial sell-off.

The stock has been under pressure since February 20, witnessing a decline of over 26% across six consecutive trading sessions. The last two trading days alone accounted for a nearly 16% drop, highlighting growing investor anxiety. While broader market sentiment remained positive, BSE’s stock struggled due to mounting fears that SEBI’s proposed risk framework could negatively affect trading activity.

On February 24, SEBI issued a consultation paper suggesting changes in the methodology used to calculate open interest (OI) in equity derivatives. The regulator proposed shifting from the existing notional terms-based approach to a future-equivalent or delta-based model. This move aims to improve risk assessment, curb market manipulation, and better align derivatives trading with cash market liquidity. However, proprietary traders, who currently contribute around 70% of BSE’s average daily turnover, could see their trading activities constrained under the new framework. As a result, trading volumes on BSE may suffer, further dampening investor confidence.

Goldman Sachs has projected that these regulatory changes will lead to a decline in the industry’s options premium-to-cash equity turnover ratio, reducing it from 0.4x to 0.3x. The brokerage also anticipates that the share of index options contracts in daily premium trading will be capped at around 30%, compared to the 22% recorded in February. This suggests a potential slowdown in options trading, a key revenue source for BSE.

Adding to investor concerns, BSE has also come under legal scrutiny. A Mumbai court recently directed authorities to file a First Information Report (FIR) against former SEBI chairperson Madhabi Puri Buch, two BSE officials, and others, in connection with alleged irregularities related to granting listing permissions to a company in 1994. This legal development has further contributed to the negative sentiment surrounding BSE, raising questions about corporate governance and regulatory oversight.

In response to these developments, Goldman Sachs has revised its earnings projections for BSE downward, cutting its estimated earnings per share (EPS) for FY26, FY27, and FY28 by 14%, 12%, and 11%, respectively. These reductions indicate expectations of weaker profitability in the coming years, reinforcing concerns about the stock’s long-term outlook.

Despite the recent sell-off, BSE’s stock has delivered strong returns over the past three years, surging 548%. Over the past year, it has gained 92%, making it one of the top-performing stocks in its segment. However, with regulatory uncertainties and a potential decline in trading volumes, investors remain cautious about the stock’s future trajectory. Market participants will closely monitor SEBI’s final decision on the proposed regulatory changes, as its implementation could significantly influence BSE’s performance in the coming months.

Check out TimesWordle.com for all the latest news

You must be logged in to post a comment.