Bitcoin Price Up 1.5% Despite Market Fears – Don’t Miss Out!

Bitcoin rose 1.5% to $68,826.3 but remained within its $60,000-$70,000 range as market concerns over U.S. inflation and interest rates persisted. Mt Gox, the defunct cryptocurrency exchange, clarified that it has no immediate plans to sell its Bitcoin holdings, instead preparing to reimburse creditors, easing fears after it moved $9 billion in Bitcoin earlier this week. Ethereum gained 0.8%, supported by optimism over a potential SEC-approved ETF, while XRP rose 0.8% and Solana (SOL) saw a stronger 3.6% increase.

Meme coins also recorded gains, with Shiba Inu (SHIB) surging 17% and Dogecoin (DOGE) up 2.6%. Despite these gains, the broader altcoin market remained cautious due to ongoing interest rate concerns. Investors are now focused on the PCE inflation data set for release on Friday, which could influence Federal Reserve policy. With Fed officials signaling prolonged high interest rates, the cryptocurrency market may face limited upside in the near term.

Bitcoin Price Up 1.5% Despite Market Fears – Don’t Miss Out!

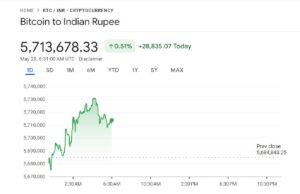

Bitcoin saw a slight price increase on Wednesday, though it continued to trade within its recent range as concerns over U.S. inflation and interest rates kept investors wary of riskier assets like cryptocurrency.

A key development came from Mt Gox, the once-dominant but now-defunct cryptocurrency exchange, which clarified that it had no immediate plans to sell its substantial Bitcoin reserves. Instead, the exchange is reportedly working on a plan to reimburse creditors. This news helped ease market concerns, leading Bitcoin to rise 1.5% over the past 24 hours, reaching $68,826.3 by 01:00 ET (05:00 GMT). Despite the uptick, the cryptocurrency remained within the $60,000 to $70,000 range that has persisted for the last two months.

Earlier in the week, Mt Gox had transferred around $9 billion worth of Bitcoin, triggering fears of an imminent sell-off. However, the absence of any immediate liquidation has reassured traders, reducing short-term selling pressure.

Mt Gox: No Immediate Sell-Off

Reports confirmed that Mt Gox has no urgent plans to liquidate its Bitcoin holdings, though it remains committed to repaying creditors. Former CEO Mark Karpeles indicated that the recent movement of Bitcoin was likely part of preparations for future distribution rather than an imminent sale.

Traders have been closely watching Mt Gox due to its vast Bitcoin reserves, which could exert significant selling pressure on the market if liquidated all at once. For now, the exchange’s clarification has alleviated concerns of a sudden flood of Bitcoin into the market.

Altcoins See Gains, But Interest Rate Worries Linger

Altcoins also experienced modest increases on Wednesday, with Ethereum (ETH) climbing 0.8% to $3,864.29, hovering near its two-month high. This followed positive signals from the U.S. Securities and Exchange Commission (SEC) regarding a potential spot Ethereum exchange-traded fund (ETF), as similar products began trading in the UK.

Other major altcoins recorded slight gains, though market sentiment remained cautious due to concerns over prolonged high interest rates. XRP rose 0.8%, while Solana (SOL) saw a more substantial increase of 3.6%.

Among meme coins, Shiba Inu (SHIB) surged nearly 17%, while Dogecoin (DOGE) posted a more modest gain of 2.6%.

Investors are now looking ahead to the release of the Personal Consumption Expenditures (PCE) price index data on Friday. As the Federal Reserve’s preferred inflation gauge, this report could influence future interest rate decisions. Several Fed officials have signaled that rates are likely to stay high for an extended period, a factor that could weigh on the cryptocurrency market moving forward by discouraging speculative investments, reducing liquidity, and making traditional assets more attractive, potentially limiting further price surges in Bitcoin and altcoins.

Check out TimesWordle.com for all the latest news

You must be logged in to post a comment.