Billions, Breakthroughs, and a Backlash: Can India’s AI Summit Ambitions Survive Reality?

Billions, Breakthroughs, and a Backlash: Can India’s AI Summit Ambitions Survive Reality?

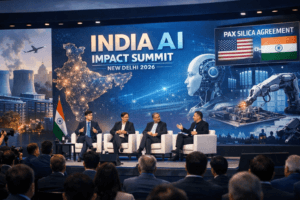

The scene in New Delhi last week was one of calculated spectacle. On the stages of the India AI Impact Summit, a parade of the world’s most powerful tech leaders—Sam Altman of OpenAI, Sundar Pichai of Alphabet, Demis Hassabis of Google DeepMind—rubbed shoulders with Indian tycoons and government ministers. The air crackled not just with the hum of servers, but with the currency of the modern era: promises.

And what promises they were. Against the backdrop of a nation determined to claim its place at the high table of global technology, a cascade of billion-dollar commitments was announced. Indian conglomerates Reliance and Adani unveiled staggering plans to invest a combined $210 billion into AI data centers over the next decade. U.S. giants like Microsoft pledged $50 billion to the “Global South,” while OpenAI, AMD, and Blackstone inked new partnerships on Indian soil. On the surface, it was a coronation. India, the world’s most populous nation and a burgeoning digital economy, was being anointed as the next great AI superpower.

But beneath the glittering surface of press releases and stage-managed panels, a more complex and turbulent story was unfolding. The summit was a vivid snapshot of a nation at a crossroads: armed with immense ambition and attracting unprecedented foreign interest, yet grappling with the messy realities of infrastructure, private capital, and the ghosts of its own controversies. The question echoing through the convention halls and coffee breaks wasn’t if India could become an AI powerhouse, but at what cost, and for whose benefit?

The Great Land Grab for Compute

The headline numbers from the summit were almost too large to comprehend. Reliance’s reported plan to funnel $110 billion into data infrastructure and Adani’s $100 billion AI data center vision aren’t just investments; they are a declaration of intent. They signal a fundamental belief that the future of value creation lies not just in writing code, but in owning the physical earth on which the digital world runs—the land, the power, and the water required to cool millions of servers.

This is the “compute” arms race. For years, the conversation around AI dominance focused on algorithms and talent. Now, the bottleneck is infrastructure. Training models like GPT-5 or Google’s Gemini require hyperscale data centers that consume as much electricity as a small city. By staking such massive claims, Indian giants are betting that the subcontinent can become a global hub for this critical resource.

“It’s a smart, if capital-intensive, move,” observed a tech infrastructure analyst who spoke on condition of anonymity. “These conglomerates understand that whoever controls the compute layer controls the ecosystem. They are building the digital factories of the 21st century, and they’re telling the world’s biggest tech companies: ‘If you want to play in India and the Global South, you’ll need to rent space in our factories.'”

This dynamic was on full display with the announcements from U.S. firms. Microsoft’s pledge isn’t just charity; it’s a strategic alignment that will likely see its Azure cloud platform power many of these new Indian ventures. Similarly, Nvidia’s expansion of partnerships with Indian venture capital firms is a bid to get its chips into the ground floor of the next generation of Indian tech stars. It’s a symbiotic relationship: India gets the capital and hardware to build its future, and the U.S. tech titans secure their dominance in a vital market.

The Talent Paradox and the “DeepSeek” Dream

Perhaps the most tantalizing prospect raised at the summit was the possibility of India moving beyond being a consumer of AI to a genuine creator of foundational models. Microsoft President Brad Smith captured this sentiment perfectly when he suggested that the world would see more “DeepSeek moments”—referring to the surprising rise of a Chinese AI lab—and that some of them would inevitably happen in India.

This optimism is rooted in India’s undeniable demographic dividend. It boasts one of the world’s largest pools of STEM graduates and a diaspora that holds leadership positions at almost every major AI firm in Silicon Valley. The raw material, the human ingenuity, is abundant.

Yet, as Anirudh Suri of the India Internet Fund pointed out, there’s a missing piece: patient, risk-tolerant private capital. India’s public markets have been on a tear, but the venture capital ecosystem that fueled the AI revolutions in the U.S. and China is still maturing. Building a foundational AI model is a multi-billion-dollar gamble with no guaranteed return. While the Reliances and Adanis of the world can fund infrastructure, funding the moonshot research and high-risk startups requires a different kind of financial engine—one that India is still working to build.

“The government and big industry are laying the railroad tracks,” Suri told CNBC. “But we need more train companies. We need hundreds of entrepreneurs building applications, tools, and yes, potentially even foundational models. That requires a vibrant, deep venture capital ecosystem that’s willing to write big checks and wait a decade for a return.”

The Gates-Shaped Hole and the Robot Dog Fiasco

For all the talk of billions and breakthroughs, the summit was also a masterclass in how human drama and on-the-ground realities can puncture the most carefully managed narrative. The abrupt withdrawal of Bill Gates cast a long shadow. While officially cited for personal reasons, the move followed public backlash over his past associations with Jeffrey Epstein. His absence was a stark reminder that in the age of social media, the past is never truly past, and the court of public opinion can be just as powerful as any government body.

Then there was the bizarre incident involving the “Indian-made” robot dog. A university’s proud claim of a domestically developed, commercially available quadruped was quickly debunked when it was revealed to be a Chinese-made unit, simply rebranded. The incident, widely mocked online, became a convenient metaphor for India’s AI aspirations: a desire to project self-sufficiency and cutting-edge innovation, undercut by a reality that often involves importing the core components.

“It was embarrassing, but also telling,” said Udith Sikand, senior emerging markets analyst at Gavekal, who offered a more skeptical take on the summit’s fanfare. “It highlights the gap between the ‘splashy attempts’ to kickstart an AI push and the underlying difficulties of actually doing business and innovating in India. You can announce $100 billion in data centers, but if the power supply is unreliable or land acquisition is a bureaucratic nightmare, those are just numbers on a page.”

Sikand’s point touches on the perennial challenges of the Indian market: complex regulations, infrastructure deficits, and a business environment that can often feel like it’s working against the very innovation it seeks to foster. The foreign executives flying into Delhi may see a market of 1.4 billion people, but they also have to navigate a labyrinth of local rules.

The Geopolitical Chessboard: Pax Silica and the Trump Factor

The summit was not just a commercial enterprise; it was a deeply geopolitical one. The presence of world leaders and the signing of the “Pax Silica” agreement—a U.S.-led initiative to secure the global silicon supply chain—underscored this. In an era of U.S.-China tech decoupling, India is being actively courted as a trusted alternative. Washington sees New Delhi as a vital partner in reducing dependence on Chinese manufacturing and ensuring the resilience of everything from chips to the data centers that will power future AI.

This was reinforced by the looming prospect of a U.S.-India trade pact. Lowering tariffs and increasing economic cooperation would be a massive boon for American tech companies looking to deepen their footprint in India, and for Indian firms seeking access to the U.S. market.

The shadow of the Trump administration’s trade policies, including a recent hike in global tariffs, added another layer of complexity. For India, the challenge is to position itself as an indispensable partner to the West while maintaining its strategic autonomy. For the U.S., the goal is to lock India into a technology alliance that can counterbalance China’s influence. The AI summit, therefore, was as much a diplomatic dance as it was a business conference.

From Billions to Impact: The Real Work Begins

As the executives boarded their private jets and the banners were taken down, New Delhi was left with the real work. The $210 billion in pledges from Indian firms are long-term visions, not immediate capital expenditure. The partnerships with U.S. giants are frameworks that need to be executed.

The summit succeeded in one crucial aspect: it captured the world’s imagination and signaled that India is open for AI business. The attendance of Altman, Pichai, and Amodei was a powerful endorsement of the country’s potential. The world’s top AI minds now have India on their radar in a way they didn’t five years ago.

But the summit’s controversies and the sobering analyses from experts serve as a necessary counterweight. They remind us that ambition is not achievement. For every billion dollars pledged, there is a need for a stable power grid. For every world-class research partnership, there is a need for a venture capital firm willing to fund the crazy startup idea.

India’s AI journey is not a sprint to “superpower” status, but a marathon of building foundational layers: digital infrastructure, a culture of high-risk innovation, and a regulatory environment that is predictable and enabling. The billions committed in Delhi are the entry fee. The hard part—nurturing the talent, funding the moonshots, and navigating the geopolitical minefield—is just beginning. The world will be watching to see if India can turn its summit of promises into a genuine era of progress.

You must be logged in to post a comment.