Beyond the Metropolis: How India’s Smaller Cities Are Redefining the Health Insurance Landscape

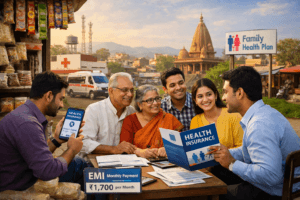

India’s retail health insurance market is experiencing a profound geographical shift, with Tier-2 and Tier-3 cities now driving the majority of new policy growth as demand in major metros plateaus. This transformation is fueled by greater digital access, which empowers consumers with information, combined with trusted local intermediaries who build essential vernacular trust. Notably, buyers in these smaller cities are opting for more sophisticated, high-value coverage—moving beyond basic plans to select higher sum insured policies, modular products with tailored add-ons, and flexible EMI payment options that align with local cash flows.

This trend reflects a deeper understanding of healthcare costs and a strategic approach to financial planning, indicating that health insurance is evolving from an urban tax-saving instrument into a mainstream pillar of household security across India’s heartland, offering a replicable model for other emerging markets facing similar dynamics of medical inflation and aspirational middle-class growth.

Beyond the Metropolis: How India’s Smaller Cities Are Redefining the Health Insurance Landscape

For decades, the narrative of India’s insurance growth was scripted in its metropolitan hubs—Mumbai, Delhi, Bangalore. Today, a quiet, profound revolution is unfolding in the country’s Tier-2 and Tier-3 towns, transforming retail health insurance from an urban privilege into a mainstream financial priority for middle India. This isn’t just about geographical expansion; it’s a fundamental shift in consumer behavior, product sophistication, and financial planning that holds lessons for emerging markets across Asia.

The New Epicenters of Growth: Digital Bridges and Local Trust

The data is unequivocal: non-metro regions now drive the market. Increasing from 54% to 62% of new policy sales on leading platforms in just five years, this surge is underpinned by two critical pillars: unprecedented digital access and the enduring power of local intermediaries.

The smartphone has become a great democratizer. High-speed internet in cities like Jaipur, Lucknow, Coimbatore, and Patna has leveled the information playing field. Consumers can now compare policies, understand exclusions, and calculate coverage needs without relying solely on an agent’s pitch. This digital literacy has bred a more confident buyer. However, technology hasn’t replaced human touch; it has fused with it. Insurers and aggregators have smartly leveraged local distribution partnerships—with regional banks, non-banking financial companies (NBFCs), and trusted community agents. These local figures translate digital options into vernacular understanding, building essential trust for a product predicated on future uncertainty. The growth is now sustained by a healthy mix of first-time buyers and renewals, indicating that health insurance is shedding its “push product” tag in these regions to become a staple of household finance.

Not Just Quantity, But Quality: The Aspirational Cover Shift

The most telling insight is not the number of policies sold, but their quality. The move away from basic ₹3-5 lakh covers toward mid (₹10-14 lakh) and high (₹15 lakh+) sum insured options reveals a sophisticated understanding of healthcare economics. What’s driving this?

First, the stark reality of medical inflation. News of hospital bills for critical ailments travels fast in close-knit communities. The awareness that a serious cardiac event or cancer treatment in a private facility can easily exhaust a ₹5 lakh cover is now widespread. Customers are proactively seeking protection that matches potential financial catastrophe, not just minor hospitalization.

Second, the rise of modular, add-on driven policies. Today, over 95% of policies sold are modular. Buyers in Kota or Nagpur aren’t just picking a plan; they’re curating one. They’re attaching riders for consumables (which can account for 10-15% of a bill), opting for room rent relaxations to ensure choice, and including outpatient (OPD) benefits for diabetes or hypertension management—conditions prevalent in smaller cities due to changing lifestyles. The average of nearly two add-ons per policy signifies a buyer thinking about out-of-pocket expenses, not just the headline sum insured. This is a leap from seeing insurance as a mere tax-saving instrument to viewing it as a comprehensive health financial management tool.

The EMI Revolution: Aligning with Real-World Cash Flows

Perhaps the most transformative behavioral change is the embrace of Equated Monthly Instalments (EMIs) for premium payments. In Tier-3 locations, 41% now choose monthly payments, a figure that underscores a deep understanding of local economic rhythms.

For the young professional in Indore, the shop owner in Varanasi, or the schoolteacher in Guwahati, cash flow is often uneven or tied to monthly cycles. A lump-sum annual payment of, say, ₹20,000 can be a significant barrier. Breaking it into monthly outlays of approximately ₹1,700 transforms it from a daunting investment into a manageable monthly subscription for family security. This payment flexibility does more than just boost uptake; it integrates insurance into the monthly budgeting psyche, similar to a mobile or utility bill, enhancing the likelihood of long-term renewal and loyalty.

Household Structures Shaping Product Choices

The product mix mirrors the social fabric. The higher proportion of family floater policies in Tier-2 (61%) and Tier-3 (59%) markets, compared to Tier-1 (57%), speaks to the prevalence of joint and multi-generational households. In these settings, a single, shared sum insured for parents, spouse, and children is not just economically efficient but culturally logical. It reflects a collective approach to family welfare. Meanwhile, the notable share of senior citizen plans (7-9%) across all tiers highlights the growing, and often urgent, need to secure coverage for aging parents, a pressing concern in a country with a rapidly graying population and rising age-related ailments.

Implications for Insurers and the Asian Market

This evolution presents both a blueprint and a challenge for insurers.

- Product Innovation Must Go Deeper: The success of modular products means insurers must develop relevant, customizable building blocks. Riders for specific regional disease profiles, bundled packages for common family structures, and simple, transparent OPD covers will be key.

- Distribution Needs a Hybrid Engine: A pure digital or pure physical model will fail. The winning strategy is a seamless omnichannel approach—digital platforms for research and purchase, complemented by local advisors for trust-building, claim support, and complex queries.

- Claims Experience is the Ultimate Test: As penetration deepens, the surge in claims from these regions will test insurer infrastructure. Establishing efficient, empathetic, and fast claim settlement networks through localized Third-Party Administrators (TPAs) or direct partnerships with regional hospitals will define brand reputation.

- A Lesson for Asia-Pacific: The Indian trajectory—from basic penetration to higher sums insured, modularization, and EMI adoption—offers a replicable model for Indonesia, Philippines, Vietnam, and others. In markets with growing middle classes, uneven cash flows, and strong family units, similar product and payment innovations can unlock growth.

Looking Ahead: Sustainability in the Face of Cost Pressures

This promising growth unfolds against a tough backdrop: global medical cost inflation, projected at 14% for Asia-Pacific in 2026. For India’s non-metro markets, this means the very costs propelling demand for higher coverage also threaten its affordability. Insurers will need to balance this through smarter risk pooling, preventive health initiatives (like wellness programs linked to policy discounts), and leveraging data analytics for accurate pricing.

The journey of health insurance in India is charting a new course, one that leads straight through the heart of its smaller cities and towns. This is more than a market expansion; it’s a story of aspirational financial security, powered by technology, tailored for local realities, and fundamentally reshaping how a billion-strong nation prepares for its health and future. The metropolis may have written the first chapter, but the story’s compelling climax is being authored in the vibrant, ambitious towns of emerging India.

You must be logged in to post a comment.