Beyond the Headlines: Unpacking India’s Proposed GST Overhaul – Relief, Risks, and Real Impact

India proposes a major GST simplification, reducing rates from five slabs to two primary tiers (5% for essentials, 18% standard) plus a 40% “sin tax” on items like tobacco. Announced as a “Diwali gift” by PM Modi, the reform specifically targets relief for farmers, health products, handicrafts, and insurance, aiming to boost household spending and MSME competitiveness. While promising lower prices on daily essentials and easier compliance for small businesses, critical questions remain.

Key concerns include potential price hikes for goods shifted from the current 12% to 18%, the immediate impact on government revenue despite long-term compliance hopes, and the challenging task of clearly defining “essential” items. States’ approval in the decisive September GST Council meeting is vital for finalizing the item classifications and navigating fiscal risks before implementation.

Beyond the Headlines: Unpacking India’s Proposed GST Overhaul – Relief, Risks, and Real Impact

The Indian government’s proposal to radically simplify the Goods and Services Tax (GST) structure isn’t just tax tinkering; it’s a potential economic reset button. Moving from five slabs to two primary rates (5% and 18%), plus a 40% “sin tax” for items like tobacco, promises significant shifts for consumers, businesses, and the economy. But what does this “Diwali gift” truly hold? Let’s look beyond the announcement.

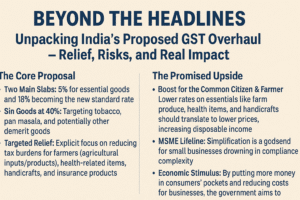

The Core Proposal: Simplicity as Strategy

- Two Main Slabs: 5% for essential goods and 18% becoming the new standard rate. This means eliminating the current 12% and 28% slabs (except for the sin tax category).

- Sin Goods at 40%: Targeting tobacco, pan masala, and potentially other demerit goods.

- Targeted Relief: Explicit focus on reducing tax burdens for farmers (agricultural inputs/products), health-related items, handicrafts, and insurance products.

The Promised Upside: Why the Government is Betting Big

- Boost for the Common Citizen & Farmer: Lower rates on essentials like farm produce, health items, and handicrafts should translate to lower prices, increasing disposable income, especially for lower and middle-income households and rural communities. Cheaper insurance could improve financial security penetration.

- MSME Lifeline: Simplification is a godsend for small businesses drowning in compliance complexity. Fewer rates mean easier filing, reduced classification disputes, and potentially lower operational costs. Handicraft and agricultural MSMEs stand to gain from specific rate cuts.

- Economic Stimulus: By putting more money in consumers’ pockets and reducing costs for businesses, the government aims to spur consumption and investment, acting as a catalyst for broader economic growth.

- Long-Term Revenue Optimism: The government acknowledges potential short-term revenue loss but bets that lower rates will boost formal sales volumes and improve compliance (less incentive to evade taxes), eventually widening the tax base and stabilizing revenue.

The Critical Questions & Potential Challenges

- The 12% to 18% Jump: What happens to items currently at 12%? Shifting them to 18% could mean price increases for a significant basket of goods and services (potentially including textiles, certain processed foods, specific services). The government hasn’t clarified which items move where – this redistribution is crucial and contentious.

- Revenue Gamble: The immediate fiscal impact is a genuine concern. States heavily reliant on GST compensation may be wary. Will increased volume and compliance really offset the rate cuts quickly enough, especially in an uncertain global economy?

- “Essential” vs. “Standard” Ambiguity: Defining which goods and services truly belong in the 5% “essential” category versus the 18% “standard” bracket will be a major negotiation point in the September GST Council meeting. Expect intense lobbying from various industries.

- Service Sector Impact: While insurance is highlighted for relief, many services currently at 18% might stay there. Could simplification inadvertently squeeze service providers if input costs don’t fall proportionally?

- State Buy-in: GST Council approval is mandatory. States have diverse economies and revenue priorities. Achieving consensus on the final item classification and managing potential revenue shortfalls will be key hurdles before Diwali.

A Genuine Human Perspective:

For a small handicraft artisan in Rajasthan, a 5% GST instead of 12% or 18% could mean better margins and competitiveness. A farmer selling produce might see slightly better prices if trader margins shrink with lower GST. A family budgeting for health insurance premiums could breathe easier.

Conversely, a local garment shop owner facing an 18% GST instead of 12% on certain items might struggle to absorb the cost or risk losing price-sensitive customers. A service provider operating on thin margins might find the 18% standard rate challenging if their input costs don’t decrease.

The Road Ahead: September is Key

The September GST Council meeting isn’t just a formality; it’s where the rubber meets the road. The final structure – exactly which items land in the 5% basket versus the 18% basket – will determine the real winners and losers. The government’s ability to convincingly address state revenue concerns and manage the transition will be critical.

Conclusion: More Than Just Simplicity

This proposed GST overhaul is a bold gamble aiming for long-term economic efficiency and growth through simplicity and targeted relief. The potential benefits for consumers (especially on essentials), farmers, and MSMEs are substantial. However, the success hinges entirely on the delicate balancing act in September: mitigating price shocks for items moving to higher rates, ensuring revenue stability for states, and clearly defining the “essential” category. If navigated wisely, it could indeed be a significant Diwali gift for the economy. If not, the simplification could come with unintended costs. The nation watches, and the GST Council deliberates.

You must be logged in to post a comment.