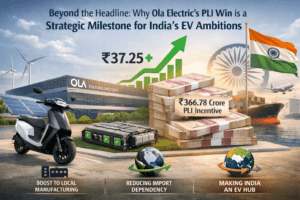

Beyond the Headline: Why Ola Electric’s PLI Win is a Strategic Milestone for India’s EV Ambitions

Ola Electric’s recent 5% share price surge, triggered by securing a ₹367 crore PLI-Auto incentive, represents far more than a simple financial boost; it is a strategic validation of India’s ambitious “Make in India” vision for advanced automotive technology. This performance-linked incentive confirms Ola’s successful execution in scaling domestic manufacturing, deepening localisation, and building vertically integrated supply chains for electric vehicles, directly aligning corporate growth with national goals of reducing import dependency and creating a global EV hub. The funds reinforce the company’s balance sheet and competitive moat, while the government’s sanction signals credibility to the entire ecosystem, demonstrating that policy support is translating into tangible outcomes for firms investing heavily in India’s industrial future. Ultimately, this milestone underscores that Ola’s journey is becoming a key case study in how aligning with strategic national priorities can fuel both market confidence and long-term technological sovereignty.

Beyond the Headline: Why Ola Electric’s PLI Win is a Strategic Milestone for India’s EV Ambitions

The news that Ola Electric’s share price surged over 5% to ₹37.25 on the National Stock Exchange is, on the surface, a straightforward market reaction to a positive financial development. The company secured a substantial ₹366.78 crore incentive under the government’s Production Linked Incentive (PLI-Auto) scheme for the fiscal year 2025. However, to view this merely as a cash infusion triggering a stock bump is to miss the profound narrative at play. This sanction is less a bonus and more a validation—a hard-earned report card on India’s aggressive bet on becoming a self-reliant powerhouse in advanced automotive technology.

Decoding the PLI-Auto Scheme: More Than Just a Subsidy

First, it’s crucial to understand what the PLI-Auto scheme truly represents. Approved in September 2021 with a massive outlay of nearly ₹26,000 crore, this isn’t a blanket subsidy for manufacturing. It’s a performance-linked marathon designed with a clear strategic vision. The scheme specifically targets the domestic manufacturing of Advanced Automotive Technology (AAT) products, a category dominated by electric vehicles and their critical components like batteries, powertrains, and sophisticated electronics.

The core objectives are multifaceted:

- Reduce Import Dependency: By incentivizing local production of AAT products, India aims to shrink its reliance on imported EV components, particularly from China, thereby strengthening its economic and strategic autonomy.

- Forge Resilient Supply Chains: The scheme encourages companies to build deep, local supplier networks, moving beyond assembly to genuine value creation within the country.

- Catalyze Global Hub Ambitions: The ultimate goal is to position India not just as a large domestic market, but as a competitive global manufacturing and export hub for cutting-edge automotive technology.

Ola Electric’s successful claim of ₹367 crore is a testament that it has met stringent, pre-defined thresholds for scale, localisation, and sales value of these AAT products. The Ministry of Heavy Industries’ sanction is a formal stamp, confirming that Ola is executing according to the script of national industrial policy.

Ola Electric’s Triumph: A Case Study in Vertical Integration

The company’s statement hits the right notes, emphasizing “scale, localisation, and technology-led vertically integrated manufacturing.” This is the crux of their qualification. Ola’s journey, from a ride-hailing brand to an EV manufacturer, has been audacious and fraught with challenges, including public scrutiny over product quality and service. Yet, their commitment to building the “Futurefactory” in Tamil Nadu—one of the world’s largest two-wheeler EV plants—is a tangible, large-scale bet on domestic manufacturing.

This PLI incentive validates that bet. It suggests Ola is not merely importing kits and assembling them, but is deepening the indigenous content in its scooters. Every percentage point increase in localisation makes the supply chain more robust, costs more predictable, and innovation more rooted. The incentive money, while significant, arguably serves more as working capital to further accelerate this very cycle of investment, scaling, and innovation.

The Ripple Effects: Confidence, Cash, and Competition

The market’s positive reaction is rational for several reasons:

- Financial Health and Promoter Confidence: The news follows closely on Ola’s announcement of the promoter clearing a ₹260 crore personal loan by monetizing a small shareholding, reducing pledged shares to zero. Together, these events paint a picture of strengthening financial and promoter stability. A cash influx from the PLI improves the company’s balance sheet, potentially funding more R&D or expansion without immediate dilution.

- Competitive Moats: In the brutally competitive Indian EV two-wheeler space, where multiple players are vying for market share, such a large incentive creates a tangible moat. It rewards early and sizable investment in local manufacturing, something newer or smaller entrants may struggle to match at pace. This solidifies Ola’s position as a first-mover not just in sales, but in building sanctioned manufacturing capacity.

- Signaling to the Ecosystem: The successful disbursement sends a powerful signal to the entire EV ecosystem—component suppliers, investors, and potential new entrants. It demonstrates that the government’s PLI commitments are real and achievable, de-risking further investments across the value chain.

The Road Ahead: Hyperservice, Scale, and Sustainable Unit Economics

However, the PLI win is a milestone, not the finish line. The incentive addresses the manufacturing leg of the stool. Ola’s recent parallel focus on expanding its “Hyperservice” initiative, promising same-day service, is a critical acknowledgment that the other leg—customer experience and lifecycle ownership—needs equal fortification. For long-term brand loyalty and repeat purchases, a reliable service network is as important as a locally manufactured scooter.

The fundamental challenge for Ola Electric, and indeed for all EV players, remains achieving sustainable unit economics at scale. The PLI incentive aids this by improving margins on manufactured units. However, the path to profitability is paved with continuous technological improvement (like battery energy density), cost optimization, and building a sticky brand.

A Microcosm of “Make in India”

In conclusion, Ola Electric’s 5% stock jump is a fleeting numeric reflection of a deeper strategic victory. This PLI sanction is a case study in the alignment of corporate ambition with national policy. It shows that when a company’s growth model dovetails with a country’s industrial goals—creating jobs, building technology depth, reducing imports—the synergies can be powerful.

For India, every such successful sanction under the PLI-Auto scheme is a step toward its vision of a globally integrated, technologically advanced automotive hub. For Ola, it’s fuel for the next leg of the race, providing not just capital but crucial credibility. The true value of this ₹367 crore will be measured not in quarterly earnings alone, but in how it accelerates India’s electric transition and fortifies the foundations of an industry built for the decades ahead. The market has reacted to the news; now, the industry watches for the execution that must follow.

You must be logged in to post a comment.