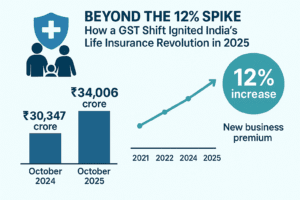

Beyond the 12% Spike: How a GST Shift Ignited India’s Life Insurance Revolution in 2025

Driven primarily by an exemption from the Goods and Services Tax (GST) that made policies more affordable, India’s life insurance industry witnessed a significant 12% year-on-year surge in new business premiums for October 2025, reaching ₹34,006 crore. This growth was marked by a dramatic divergence in strategies; the state-owned LIC capitalized on mass-market demand, seeing a 29.4% jump in individual premiums and a 120% explosion in policy count, while private insurers experienced a 17.3% dip in individual premiums as they likely focused on higher-value segments.

The overall 62.7% surge in policies sold to 1.95 million indicates a profound expansion in financial inclusion, signaling that the tax relief successfully spurred a long-term shift by bringing millions of new households into the formal insurance ecosystem and accelerating the industry’s growth trajectory.

Beyond the 12% Spike: How a GST Shift Ignited India’s Life Insurance Revolution in 2025

The headline is arresting: Life insurers’ new business premium surges 12% in a single month. For an industry often perceived as steady and predictable, a double-digit jump is more than just a good month—it’s a signal. The data from October 2025 reveals not just a statistical blip but a profound shift in the Indian financial landscape, driven by a pivotal policy change and evolving consumer mindsets. This isn’t merely a story of rising numbers; it’s a narrative about the changing relationship between the Indian household and financial security.

Deconstructing the October 2025 Surge: More Than Meets the Eye

At first glance, the numbers are impressive. The Life Insurance Council reported a New Business Premium (NBP) of ₹34,006 crore, a robust 12.06% increase from October 2024. This translates to an additional ₹3,659 crore flowing into the industry’s coffers in just one month. But to stop here is to miss the real story. The catalyst, as cited, is the “exemption from the Goods and Services Tax (GST).”

But what does this actually mean for the average person? Previously, GST was levied on the premium amounts for most life insurance products. This wasn’t a tax on the final benefit or the maturity amount, but a cost added to the ongoing premium payments. Its removal effectively made life insurance policies cheaper overnight. For a middle-class family budgeting for a ₹50,000 annual premium, the GST exemption could mean immediate savings of several thousand rupees per year. This direct financial incentive didn’t just nudge prospective buyers; it shoved them off the fence.

The Ripple Effect of the GST Exemption:

- Increased Affordability: Overnight, comprehensive coverage became more accessible. A term insurance plan that was once slightly out of budget now fit comfortably, allowing individuals to purchase higher sum assureds for the same outlay.

- Psychological Trigger: The removal of a “tax” framed insurance not as a cost, but as a purer, more efficient investment in security. It eliminated a mental barrier for many who viewed the GST component as an unnecessary government levy on a necessary financial product.

- Boosted Agent Morale: For the vast network of insurance advisors, this was a powerful new talking point. They could now lead with a tangible price advantage, making their propositions more compelling and closing sales faster.

The Great Divergence: LIC’s Stunning Resurgence vs. Private Players’ Strategic Pivot

The aggregate growth of 12% masks a fascinating corporate drama unfolding beneath the surface. The industry’s two giants—the state-owned behemoth LIC and the collective force of private insurers—took markedly different paths to achieve their growth.

LIC: The Sleeping Giant Awakens LIC reported a 12.5% YoY increase, but this headline figure belies a seismic shift in its business composition. The real story is in the individual segment, where LIC’s premium skyrocketed by an astonishing 29.4%. This is a clear indicator that the GST relief was a boon for the mass market—LIC’s traditional stronghold. The brand, synonymous with trust and security for millions of Indians, leveraged its unparalleled penetration in Tier 2 and Tier 3 cities. The price sensitivity in these markets is high, and the GST exemption likely converted a vast pool of “considering” customers into “buying” ones.

Furthermore, LIC’s policy sales exploding by 120% is perhaps the most telling statistic of all. It signifies a massive volume play. LIC wasn’t just selling high-value policies to a few; it was selling a vast number of policies to the masses. This suggests a successful push for smaller-ticket, more accessible products, bringing a new segment of first-time insurance buyers into the formal financial fold.

Private Insurers: A Story of Segmentation and Selective Growth Private insurers, with an 11.5% overall premium growth, present a more complex picture. While their group business grew healthily at 10.3%, their individual premium saw a 17.3% dip. How can overall growth coexist with a decline in the core individual business?

The answer lies in the nature of the policies sold. Private players have long focused on Unit-Linked Insurance Plans (ULIPs) and complex, high-value savings-cum-protection products. The GST exemption likely had a muted effect on the high-net-worth individuals (HNIs) who buy these, as price is less of a deterrent. Instead, the surge in low-cost LIC policies may have cannibalized the entry-level segments of private players.

However, the performance within the private camp is not uniform. SBI Life led the charge with a stellar 20.3% growth, a testament to the power of its bancassurance model—leveraging SBI’s vast branch network to reach customers seamlessly. HDFC Life’s near-flat growth (1.06%) and ICICI Prudential’s modest 6.5% rise suggest a strategic repositioning may be underway, possibly focusing on profitability and client retention over pure premium volume.

The Policy Count Boom: India’s Financialization Accelerates

If there’s one number that points to a sustainable future for the industry, it’s this: the number of policies sold surged 62.7% YoY to 1.95 million.

This statistic is far more significant than the premium growth. Premium can be skewed by a few large corporate group policies or high-value HNI purchases. But the policy count represents individual lives covered, individual families secured. A 62.7% increase means hundreds of thousands of new households are now part of the formal insurance ecosystem.

This is a powerful indicator of the “financialization” of Indian savings. Money that might have languished in savings accounts or been used for unproductive assets is now being channeled into structured, long-term financial security. This deepens the country’s capital markets and builds a more resilient economic foundation.

Strategic Implications: What This Means for the Road Ahead

The October 2025 data is not an anomaly; it’s a precedent. It offers crucial lessons for all stakeholders:

- For Consumers: The market is now more favorable than ever. The GST relief is a permanent advantage, making it an ideal time to review your coverage. Are you adequately insured? Could you enhance your sum assured for the same premium? The competition between LIC and private players also means more choice and better service.

- For Insurers: The “one-size-fits-all” strategy is dead. LIC has demonstrated the immense latent demand in the mass market, while private players must double down on their niches—digital-first experiences, sophisticated ULIPs, and bespoke wealth management solutions. The war will be won on segmentation and customer experience.

- For Policymakers: The data is a resounding validation of using smart fiscal policy to drive social goals. By forgoing short-term tax revenue, the government has stimulated a long-term habit of financial protection among citizens, reducing future state liability and fostering a culture of self-reliance.

Conclusion: A Paradigm Shift, Not Just a Peak

The 12% rise in October’s new business premium is more than a monthly performance metric. It marks a paradigm shift. The GST exemption acted as the key that unlocked pent-up demand, particularly in the heartland of India, propelling LIC to a stunning individual segment performance and bringing millions of new policyholders into the system.

This surge tells a story of a nation increasingly conscious of its financial security, a state-owned titan rediscovering its growth moat, and a dynamic private sector adapting to a new competitive reality. As the April-October 2025-26 cumulative growth of 8.2% shows, this is not a flash in the pan but the beginning of a new, accelerated growth phase for Indian life insurance—one built on the foundation of broader inclusion and smarter policy. The true value of this surge will be measured not in crores of premium, but in the millions of families it helps secure for decades to come.

You must be logged in to post a comment.