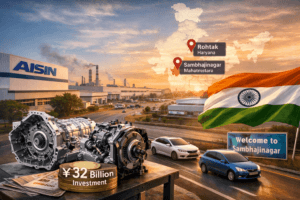

Aisin Doubles Down: How a 32 Billion Yen Bet Reflects India’s Automotive Transformation

In a decisive move to capitalize on India’s accelerating automotive shift, AISIN Corporation is investing approximately 32 billion yen to localize production of automatic transmissions, expanding its existing plant in Rohtak for CVTs and establishing a new facility in Sambhajinagar for ATs and body parts, with both slated to begin operations in 2029. This strategic investment directly addresses the market’s rapid transition from manual to automatic vehicles, aiming to reduce costs, strengthen supply chain resilience, and allow for greater customization for local OEMs. Beyond capturing immediate growth, the move complements AISIN’s existing eAxle production, positioning the company as an integrated partner through India’s automotive evolution—from conventional vehicles to EVs—while deepening local manufacturing expertise, creating skilled jobs, and solidifying India’s role as a pivotal market in global automotive strategy.

Aisin Doubles Down: How a 32 Billion Yen Bet Reflects India’s Automotive Transformation

In a move that signals both confidence and strategic necessity, Japanese automotive giant Aisin Corporation has announced a massive 32 billion yen (approximately $200 million USD) investment to deepen its manufacturing roots in India. This isn’t just another corporate expansion; it’s a calculated response to a profound shift in one of the world’s most dynamic car markets. By expanding its existing plant in Rohtak, Haryana, and establishing a new facility in Sambhajinagar, Maharashtra, Aisin is placing a significant wager on India’s accelerating transition from manual to automatic transmissions—and on its own role in shaping the country’s automotive future.

Beyond the Headlines: Decoding India’s Transmission Tipping Point

For decades, the iconic “gear shift” of the Indian passenger car was a manual one. Fuel efficiency, cost sensitivity, and driving preference kept manual transmissions (MT) firmly in the majority. However, the landscape is changing at a breathtaking pace. Rising disposable incomes, increasing urban traffic congestion, and a new generation of drivers seeking comfort and convenience are driving an unstoppable demand for automatic transmission (AT) and continuously variable transmission (CVT) vehicles.

Aisin’s investment is a direct answer to this “quiet revolution” under the hood. The decision to localize production of these complex components is a game-changer. Until now, many automakers in India have relied on importing automatic transmissions or assembling them from imported kits, which incurs higher costs, longer supply chains, and vulnerability to global disruptions. Localizing AT and CVT production addresses these pain points head-on, promising:

- Cost Reduction: Manufacturing in India avoids import duties and leverages local supply chains, potentially making automatic vehicles more affordable for the mass market.

- Supply Chain Resilience: Onshore production mitigates risks from global logistics snarls and allows for just-in-time delivery to Indian car plants.

- Customization & Speed: Proximity to OEM customers like Maruti Suzuki, Toyota, Hyundai, and others enables faster co-development and tailoring of transmissions to specific Indian driving conditions and vehicle platforms.

The Twin Engines of Growth: A Closer Look at the Investments

Aisin’s 32-billion-yen commitment is strategically split into two equal, complementary projects.

- Rohtak, Haryana Expansion: The CVT PowerhouseThe expansion of the Aisin Automotive Haryana Private Limited (AHL) plant is a16 billion yen dedicated play for the CVT market. CVTs, known for their smooth, seamless acceleration and superior fuel efficiency in certain conditions, are becoming increasingly popular in mid-range passenger vehicles.

- Location: Rohtak, in the National Capital Region, places it at the heart of India’s northern automotive corridor.

- Significance: This expansion solidifies an existing base, suggesting Aisin is scaling up proven operations to meet soaring demand. It’s a vote of confidence in the local workforce and supply chain already established there.

- Sambhajinagar, Maharashtra New Plant: The AT and Body Products HubThe new greenfield plant in Maharashtra represents another16 billion yen investment with a broader scope.

- Location: Sambhajinagar (formerly Aurangabad) is part of Maharashtra’s thriving industrial belt, with excellent port access and a strong existing automotive vendor ecosystem.

- Dual Focus: The plant will produce traditional **Automatic Transmissions (ATs)**—still the gold standard for many for their durability and performance—alongside body products. This dual-production strategy indicates an integrated approach, potentially serving a single customer with multiple key components, thereby increasing efficiency and strengthening partnerships.

With both facilities slated to begin operations in 2029, Aisin is planning for the next decade of growth, aligning with India’s projected rise to become the world’s third-largest car market.

The Ripple Effect: More Than Just Gears

The implications of this investment extend far beyond Aisin’s balance sheet.

- Supercharging ‘Make in India’: This is a textbook case of the “Make in India” philosophy in action. By moving from import-dependent to local manufacturing of high-value, precision components, Aisin is directly contributing to technology transfer, deepening India’s manufacturing expertise, and enhancing the country’s appeal as a global auto hub.

- Supply Chain Evolution: A plant of this scale doesn’t operate in isolation. It will necessitate and foster the growth of a local supplier network for precision machining, castings, electronics, and more. This uplifts the entire ancillary industry, creating a virtuous cycle of skill development and quality improvement.

- Job Creation & Skill Development: The combined plants will create thousands of jobs, both direct and indirect. More importantly, they will create skilled jobs—in mechatronics, precision engineering, and advanced manufacturing—raising the bar for the local labor market.

- Strategic Foresight & The EV Connection: It’s crucial to view this move alongside Aisin’s commencement of eAxle production in India in March 2025. The eAxle is the integrated electric drive unit, the heart of an EV. By simultaneously investing in conventional AT/CVT and cutting-edge EV components, Aisin is executing a classic “bridge strategy.” They are capturing the high-growth automatic transmission market of today while building the foundational capacity and relationships to dominate the electric vehicle market of tomorrow. This ensures relevance through the entire transition period.

A Voice from the Ground: The Human Strategic Element

Mohan Kumar, Head of India Operations for Aisin, encapsulates the human-centric strategy behind the capital expenditure: “We will deepen our collaboration with local market and customers, and promote region-centered management.” This statement is key. It moves the narrative from a simple capacity increase to one of embedded partnership. “Region-centered management” suggests decision-making authority and design input will increasingly come from within India, allowing Aisin to move with the speed and cultural nuance the market demands.

The Road Ahead: Challenges and Opportunities

The path to 2029 is not without challenges. Developing a skilled talent pool for advanced transmission manufacturing, ensuring consistent quality from a nascent local supply chain, and navigating India’s complex regulatory and infrastructural environment will be critical tasks.

However, the opportunity is monumental. Aisin is positioning itself not just as a supplier, but as a strategic partner integral to the Indian automotive industry’s modernization. By providing affordable, locally-made advanced transmissions, they can accelerate the automatic shift, making feature-rich vehicles accessible to millions more Indians.

Conclusion: A Win for Aisin, A Win for India

Aisin’s 32-billion-yen announcement is more than a financial headline. It is a bellwether for India’s automotive maturity. It confirms the irreversible trend toward automatic transmissions, underscores India’s importance in global automotive strategy, and demonstrates how foreign investment, when aligned with national priorities, can be a powerful catalyst for industrial growth.

For the Indian consumer, this means the promise of more choice, better technology, and potentially more competitive pricing in the years to come. For the Indian economy, it means higher-value manufacturing, job creation, and a strengthened position in the global auto parts map. And for Aisin, it is a decisive step towards securing a dominant, locally-rooted presence in what may soon be the world’s most crucial automotive market. The investment is a powerful testament to a simple truth: in today’s global auto industry, to win the world, you must first win the road in India.

You must be logged in to post a comment.