Airspace Crisis: 7 Shocking Impacts of Pakistan’s Ban on Indian Flights That Threaten Air India’s Survival

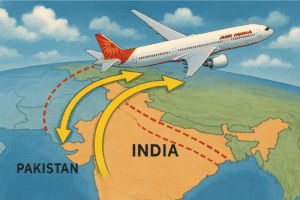

Pakistan’s airspace closure to Indian carriers, triggered by recent tensions over a Kashmir terror attack, has thrust Air India into a financial quagmire, with annual losses projected at $600 million. The airline urgently seeks government subsidies to counter spiraling fuel costs and prolonged flight times on critical routes to Europe, North America, and the Middle East. Rerouting adds up to three hours per flight, straining crew schedules and inflating operational costs.

The ripple effect extends to rivals like IndiGo and Air India Express, disrupting over 1,200 monthly international flights. India is scrambling for solutions—negotiating alternative paths via China’s airspace and weighing tax relief—mirroring 2019’s five-month closure that cost $100 million. Passengers may face pricier tickets, while Air India’s post-privatization revival risks derailment. The crisis spotlights aviation’s fragility to geopolitical strife, demanding urgent diplomacy and resilient contingency strategies to safeguard India’s booming travel sector.

Airspace Crisis: 7 Shocking Impacts of Pakistan’s Ban on Indian Flights That Threaten Air India’s Survival

India’s aviation sector is bracing for turbulence as Pakistan’s decision to close its airspace to Indian carriers triggers a financial crisis for airlines, with Air India at the epicenter. The move, a response to escalating tensions following a deadly terror attack in Kashmir, has forced flights to reroute over longer paths, inflating fuel costs and flight durations. Air India now warns of annual losses exceeding $591 million (₹50 billion) if the restriction persists, prompting urgent calls for government intervention.

The Financial Storm for Air India

Air India’s plea for a “subsidy model” underscores the severity of the crisis. The airline, already navigating a $520 million net loss in FY2023-24, faces compounding challenges:

- Soaring Fuel Costs: Rerouting flights around Pakistan adds 1–3 hours to journeys on key routes to Europe, North America, and the Middle East, increasing fuel burn by 15–20% per flight.

- Operational Strain: Extended flight times require additional crew shifts and inflate labor costs. The airline has sought approval to deploy extra pilots on U.S. and Canada routes.

- Market Dominance at Risk: With a 26.5% market share and a heavy reliance on international routes, Air India’s competitive edge against rivals like IndiGo—which focuses more on domestic and short-haul flights—is under threat.

Broader Industry Ripples

The closure impacts all Indian carriers, with over 1,200 flights scheduled in April alone between Delhi and major global hubs. IndiGo and Air India Express also face disruptions, though Air India bears the brunt due to its long-haul network. The aviation ministry is exploring solutions, including:

- Alternative Routes: Negotiating overflight permissions with China for paths across challenging Himalayan terrain.

- Tax Relief: Potential cuts in jet fuel taxes or airport fees to ease financial pressure.

- Diplomatic Outreach: Air India has urged the government to engage Chinese authorities to secure critical air corridors.

A Recurring Nightmare for Indian Aviation

This isn’t the first time geopolitical strife has disrupted air travel. In 2019, Pakistan’s five-month airspace closure during India-Pakistan tensions cost airlines over $100 million. The current closure risks longer-term damage, compounding pandemic recovery struggles and supply chain delays (e.g., deferred Boeing/Airbus deliveries).

The Human Cost: Passengers and Employees

While airlines absorb immediate costs, passengers may eventually face pricier tickets. Crews grapple with fatigue from extended shifts, raising safety concerns. Air India’s restructuring plan—a lifeline after its 2022 privatization—now faces delays, jeopardizing fleet modernization and service upgrades.

A Path Forward?

The government’s response will set a precedent for handling aviation crises. Options include:

- Targeted Subsidies: Direct financial aid for affected routes, tied to verifiable losses.

- Operational Flexibility: Relaxing crew duty limits and fast-tracking airspace agreements with neighboring countries.

- Fuel Price Reforms: Reducing taxes on aviation turbine fuel (ATF), which accounts for 40% of airline operating costs in India.

The Bigger Picture

The crisis highlights the vulnerability of global aviation to regional conflicts. With climate goals pressuring airlines to cut emissions, inefficient reroutes also undermine sustainability efforts. For India—poised to become the world’s third-largest aviation market—resolving airspace disputes is critical to maintaining growth momentum.

In Conclusion

Pakistan’s airspace closure isn’t just a diplomatic spat—it’s a stress test for India’s aviation resilience. As Air India seeks a lifeline, the government must balance short-term relief with long-term strategies to insulate the sector from geopolitical shocks. The outcome could redefine how emerging markets navigate the intersection of politics, economics, and global connectivity.

Insight: This situation underscores the aviation industry’s role as both a economic engine and a geopolitical pawn. For airlines, diversification of flight paths and stronger contingency planning may become non-negotiable in an era of escalating regional tensions.

You must be logged in to post a comment.