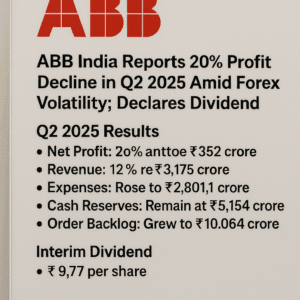

ABB India Reports 20% Profit Decline in Q2 2025 Amid Forex Volatility; Declares Dividend

ABB India reported a 20% year-on-year decline in Q2 2025 net profit, falling to ₹352 crore, attributed primarily to foreign exchange volatility and increased operational expenses. Despite this, revenue grew 12% to ₹3,175 crore, reflecting sustained business momentum. The company maintained a robust cash position of ₹5,154 crore and announced an interim dividend of ₹9.77 per share, underscoring financial stability. While quarterly orders dipped to ₹3,036 crore due to timing delays in large projects, base orders grew across key sectors including electronics, railways, and energy.

ABB’s executable order backlog reached a healthy ₹10,064 crore, providing strong future revenue visibility. Management highlighted resilience through 11 consecutive quarters of double-digit profit margins and emphasized strategic positioning in infrastructure and automation markets. The results demonstrate ABB’s ability to navigate short-term headwinds while leveraging India’s industrial growth story for long-term strength.

ABB India Reports 20% Profit Decline in Q2 2025 Amid Forex Volatility; Declares Dividend

ABB India, a leading player in electrification and automation solutions, reported a 20% year-on-year drop in net profit for the June quarter (Q2 CY2025), citing foreign exchange (forex) volatility and rising operational costs. Despite the profit dip, the company announced an interim dividend of ₹9.77 per share, reflecting confidence in its financial stability.

Key Financial Highlights

- Net Profit: Fell to ₹352 crore (from ₹443 crore in Q2 2024).

- Revenue: Rose 12% to ₹3,175 crore (up from ₹2,831 crore YoY).

- Expenses: Surged to ₹2,801.1 crore (from ₹2,323.9 crore), driven by input costs and forex impacts.

- Cash Reserves: Remained strong at ₹5,154 crore, showcasing liquidity strength.

- Order Backlog: Grew to ₹10,064 crore (from ₹9,517 crore YoY), signaling future revenue visibility.

Performance Analysis

While ABB India’s revenue growth was robust, profitability was squeezed by:

- Forex Fluctuations: Unfavorable currency movements impacted margins.

- Higher Costs: Increased expenditure on materials, logistics, and one-off expenses.

- Order Timing: Large-order delays led to a 12% drop in quarterly orders (₹3,036 crore vs. ₹3,435 crore in Q2 2024).

However, base orders (smaller, recurring contracts) saw growth, with demand from sectors like:

- Electronics & Data Centers

- Railways & Energy

- Metals, Mining, and Infrastructure

Management Outlook

Sanjeev Sharma, Country Head and Managing Director, ABB India, emphasized resilience:

“Our double-digit profit margins for 11 straight quarters and healthy cash flow reflect operational discipline. While forex headwinds hurt short-term profits, our order backlog and diversified sectoral demand position us for recovery.”

Dividend Announcement

The board approved an interim dividend of ₹9.77 per share (face value: ₹2), rewarding shareholders despite profit pressures.

Market Reaction & Future Prospects

Investors may focus on:

- Execution of ₹10,064-crore backlog to drive future revenue.

- Stabilization of forex and cost pressures in upcoming quarters.

- Demand sustainability in core sectors like infrastructure and renewables.

Conclusion

ABB India’s Q2 performance underscores the challenge of external volatility but highlights underlying strength in orders and cash reserves. The dividend payout signals confidence, while sectoral diversification offers a buffer against macroeconomic swings.

You must be logged in to post a comment.